Program of Remittances and Financial Inclusion

The Latin America and Caribbean region receives over 60,000 million USD as international remittances every year1. This cash flow sent by migrants on a regular basis and mostly collected in cash represents an opportunity for the financial inclusion of 25 million remittance clients approximately.

A study conducted on the matter revealed that only one third of remittance recipients in the region has a bank account. The exclusion of this population from the formal financial system may derive into larger insecurity levels due to the handling of cash, fostering the immediate expenditure and limiting their capacity to accrue assets with the aim at diminishing their vulnerability and conducting investments in the future. Likewise, having financial products such as savings may be the first step to eventually access other financial products and services, including credits and micro-insurances. At macroeconomic level, counting with more people within the formal financial system may also contribute to the higher financial stability levels in the relevant countries.

In order to create an appropriate environment for the remittance clients financial inclusion, this project aims at addressing the following two challenges faced by financial intermediaries: i) regulatory barriers so as to offer products and services for this population; and ii) lack of public segregated, accurate and updated information on the remittance flows in terms of origin, destination, collection and payment method as well as type of remittance service provider2.

What's new

- Mexican immigrants in the United States sent 18.5 percent of their annual labor income to their relatives in Mexico at the end of the third quarter of 2023

- U.S. wealth of the Mexican immigrant population: home ownership

- Weakness of Mexican migration flow to the U.S.

- Are remittances included in the measurement of poverty in Mexican states?

- Remittances in Mexico and household income-expenditure surveys

- Latin American migrants have made a greater effort to support their relatives in their countries of origin by sending remittances

- Better performance of the Mexican economy in the United States than that of the Mexican economy in the United States

- Mexican immigrants in the United States sent 18 percent of their cumulative annual labor income to their relatives in Mexico at the end of the first quarter of 2023

- At what times of the day are remittances sent to Mexico?

- Determinants of the percentage of income sent as remittances by Mexican immigrants in the United States to their relatives in Mexico

- Mexican immigrants in the United States sent 17 percent of their labor income to their relatives in Mexico in 2022

- Labor income of mexican immigrant workers in the United States reached 320 billion dollars in 2022

- Aspects of Mexican female migration to the United States

- Annual labor income of Mexican workers in the United States exceeded $315 billion by the end of the third quarter of 2022

- Shrinking Mexican immigrant population in the U.S.

- By how much do remittances increase the income of households receiving them in Mexico?

- The annual wage bill of mexican immigrant workers in the United States exceeded $300 billion at the end of the second quarter of 2022

- The Economy of Hispanics in the United States

- The covid-19 pandemic and remittances in Mexico

- The U.S. wage bill of native-born and immigrant workers of Mexican origin is equivalent to 55 percentage points of Mexico's GDP

- How many individuals and households receive remittances in Mexico?

- New employment and wage growth for Mexican immigrant workers in the United States

- In California and Texas the combined wage bill of Mexican immigrant workers reached $150 billion

- Remittance inflows to mexico outpace public investment

- Remittances to Latin America and the Caribbean and the effects of the COVID19 pandemic: 2020-2021

- International Migration, Remittances and Financial Inclusion: The Case of Venezuela

- International Migration, Remittances and Financial Inclusion: The Case of Costa Rica

- International Migration, Remittances and Financial Inclusion. The Case of Nicaraguan Immigrants Residing in Costa Rica

- Remittances To Latin America and The Caribbean in 2017: Greater Growth Dynamism

- Remittances to Latin America and the Caribbean 2017-2018

- Remittances to Latin America and the Caribbean in 2016: A New Record

- Remittances to Latin America and The Caribbean in 2015-2016: Accelerating their Growth

1Maldonado, R., Hayem, M. "Remittances to Latin America and the Caribbean in 2013: still below pre-crisis levels". Multilateral Investment Fund, Inter-American Developing Fund. Washington, D.C., 2014.

2For these reasons, the financial inclusion matter has become priority for many central banks in the region. In countries like Chile and Mexico financial inclusion national boards have been created aiming at facilitating the coordination of actors involved, including central banks, finance ministries, oversight entities and fostering their financial inclusion national policies.

Objectives and Components of the Program

The Program on Remittance and Financial Inclusion aims at providing central banks and other relevant authorities with support in two specific areas: a) the development of legal and regulatory frameworks to promote the development of financial services and products appropriate for remittance clients and b) publication of precise information on remittances in a segregated and updated manner so as to grasp a better understanding of the market in order to contributing to the remittance clients financial inclusion.

The inclusion of the remittance recipients' population to the financial system may derive into a larger accumulation of savings, thus paving the way to their access to other financial products and services such as credit and microinsurances. At macroeconomic level, having more people taking part in the formal financial system may also contribute to higher levels of financial stability in the relevant countries. Moreover, the enforcement of the Program contributes for the remittance recipients to benefit from a more formal participation in payment systems and an expedite access to safer services.

Problem

The relevance of remittance flows received by Latin America and the Caribbean every year as well as

the characteristics of senders and beneficiaries make them the main candidates for financial

inclusion. However, the lack of information and the absence of an appropriate regulatory framework

fostering and developing this inclusion become barriers for the private sector to design products

and services appropriate for these users, while making it impossible for the public authorities to

conduct analysis and implement both policies and strategies to uphold this aim.

Objective

Supporting central banks and other relevant authorities to identify, diminish and eliminate the

barriers for the financial inclusion of remittance clients in two specific areas: a) the regulation

that may allow the private sector to design and implement financial services and products

appropriate to remittance clients and b) transparency and availability of relevant information for

the decision making within the public and private sectors.

Strategy

Authorities from the public and private sectors will come together to identify and implement

improvements within the regulatory field that will allow to designing and offering financial

products and services linking remittances to savings, credits and productive investments. Likewise,

and in coordination with the private sector, the corresponding needs will be defined and the

required abilities will be enabled in central banks for the remittance market to have the adequate

information so as to offer the users elements allowing them to improve their decision making

process.

Components

Component I: Assessment and implementation of amendments to the regulatory framework for the financial inclusion of remittance clients

This component aims at evaluating regulatory frameworks affecting the financial inclusion of remittance clients and implementing changes to facilitate access to financial products and services.

Component II: Assessment and implementation of changes to the information gathering and disclosure on remittances and remittance clients' financial inclusion.

The objective of this component is to evaluate the available information on international remittances, design a harmonized report on remittances and build capacity within central banks and other relevant institutions in the region for their adoption and implementation to improve public information available on remittance flows by country, disaggregated in terms of origin, destination, collection and payment method as well as remittance services type of provider together with data on the financial inclusion of remittance clients. As far as possible, information will be broken down by gender. For those countries that do not get the direct benefit of technical assistance for this Program, a guide on how to improve data gathering and disclosure related to remittances will be available to central banks and other relevant institutions.

This component will also disclose the www.enviacentroamerica.org and www.transfeayiti.org databases to final users, remittances issuers including information on remittance costs and sending methods to Central America, the Dominican Republic and Haiti. Both databases have been cofinanced by MIF in previous projects with CEMLA. This time the channels used to disclose and determine the usefulness of this information for the decision making process undertaken by the consumer will be assessed. The results obtained will be the basis to decide the convenience of continuing their implementation and expansion to other countries and the executive agency will decide on a sustainability plan. The most relevant findings will be included on a technical note for general disclosure.

Program's activities and products

The products and activities generated by the program are as follows:

- Regional study on the regulatory framework affecting the remittance clients access to financial services

- Design of remittance reports attached to the balance of payment report.

- Missions conducted for diagnosis purposes.

- Description documents derived from country-based diagnosis missions.

Moreover, each diagnosis mission will derive in confidential recommendation documents to be delivered to the authority requesting such assessment, containing the diagnosis results, recommendations and an action plan to be implemented to enforce technical assistance provided to the authorities interested in doing so.

- Implementation of recommendations.

- Development of reports about characteristics of remittance issuers and recipients as well as their financial inclusion.

- Development of knowledge and disclosure products.

Studies conducted both, at regional and country level, will aim at identifying specific barriers for access to financial services and products by female remittance clients. The knowledge products deriving from them will be significant to government authorities, including central banks and financial system supervisors interested in widening financial products and services access and usage to neglected sectors in the population. Moreover, the private sector will also find them of interest since they will allow to surpassing barriers to financial inclusion faced by remittance clients and develop business strategies focused in this population, together with

- Maintenance of remittance databases.

- Diagnosis, planning and design of a databases communication strategy.

- Implementation of the databases communication and disclosure strategy.

- Assessment of disclosure channels and usefulness of the information for the consumer's decision making.

Knowledge products derived from the program will be communicated in experience exchange events (including public and private sectors) organized by CEMLA, other international and local forums within the remittance and financial inclusion industry as well as by means of CEMLA and IDB/Multilateral Investment Fund (MIF) websites.

Structure

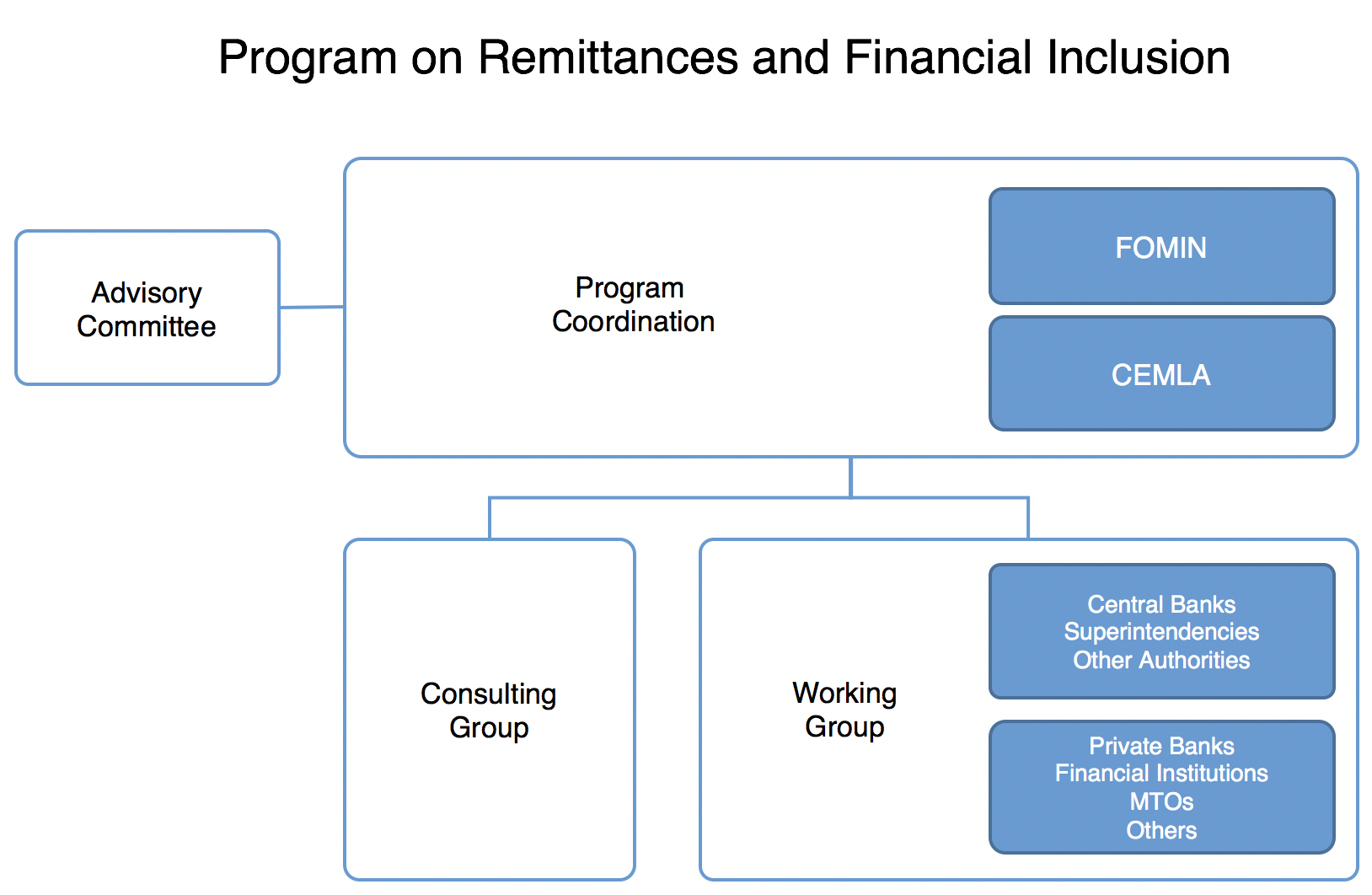

The Remittances and Financial Inclusion Program has the instruments and tools to be implemented and potentially has a significant number of beneficiaries *. Currently there are several international agencies and organizations that work on issues related to the objectives of the Program and the authorities of the countries of the region, including central banks, supervisory agencies and others, have a great interest in the financial inclusion of remittance clients. In this context, this document seeks to synthesize the way in which the different actors of the Program will be organized, and will also look into the coordination between them and the monitoring reports that will be carried out.

The Program works through the Coordination Unit, supported by the recommendations and follow-up to its activities by an Advisory Committee and the main financing entities: MIF and CEMLA.

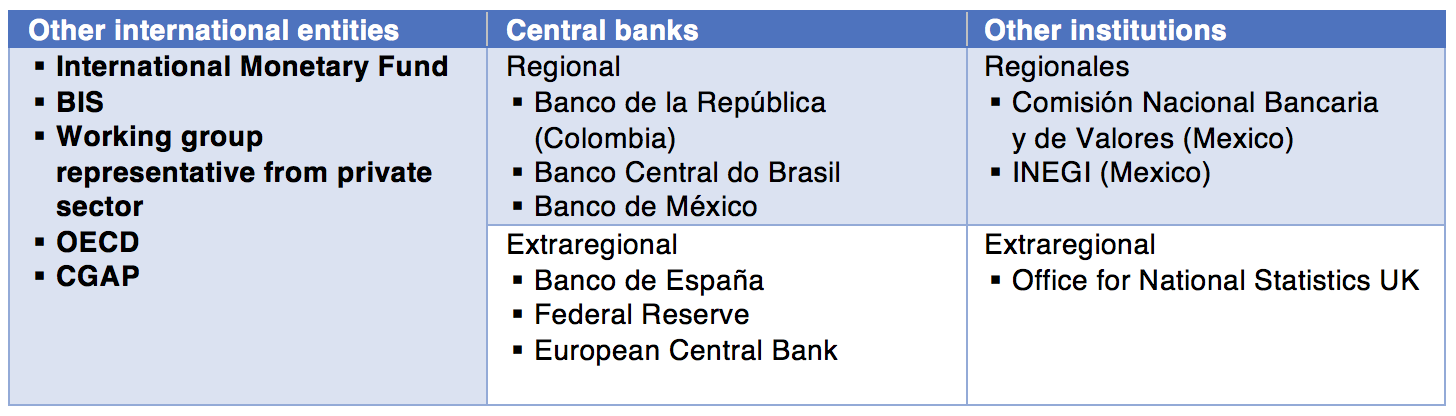

Additionally, a Consulting Group will be made up by representatives of institutions and international organizations working within similar scopes to the Program's objectives working as advisors along the Program's activities offering additional support. The foregoing aims at coordinating the Program's tasks avoiding duplicate efforts with other institutions and entities in the region.

The Program beneficiaries will be organized through the working group creating synergies derived from their local or sector-based acquired experiences. With this in mind, the working group will include the central banks, superintendencies and other local authorities as well as the representatives in the private sector. The latter will include members of the financial sector, whether of banking nature or not, remittance market operators and other remittance service providers as well as technology companies related to the transfer and payment market.

* The direct beneficiaries include central banks, oversight entities and others relevant to the Latin America and Caribbean region (LAC) that will have the support derived from the diagnosis and technical assistances. Likewise, other authorities will have access to knowledge products and participate in disclosure and experience exchange events. The indirect beneficiaries include the private sector in the remittances market, financial institutions (whether of banking nature or not), money transfer companies as well as others providing for technological services. The former under a more favorable environment and having more information will be able to expand their client basis and offer new products and services to the population both, issuing and receiving remittances.

Program Coordination

The Program Coordination aims at developing the activities from the technical and administrative standpoint and directs them to donors, the executing agency, the working group as well as the consulting and advisory committees.

Activities

The role of the Program Coordination is strategic, administrative, financial and decision-making. Also, its coordination function with the different actors making up its scope allow its objectives to be attained in a timely manner just as described on the donor's memorandum agreed upon the financing entities and the beneficiaries.

Members

The Program works with the financing, collaboration and coordination of the MIF through CEMLA acting as Execution Agency.

MIF. The Program contributes to the objectives set by MIF Savings, Payments and New Distribution Channels Agenda promoting wider access and usage of financial services among the population having none or limited access to these services in LAC, thus complementing the efforts made under the Remittance and Savings items.

The program is coherent to the Inter-American Development Bank (IDB) objective of promoting the economic growth and the reduction of poverty in LAC supporting central banks and other relevant authorities to develop a regulatory and legal framework and improve transparency with the aim at facilitating the development of financial products and services adapted to remittance clients.

Therefore, the Program will be implemented in coordination with IDB's Capital Market and Financial Institution Division (CMF) within its "Support to Comprehensive Financial Inclusion Strategies Program". The CMF Division is represented in the Program's team and will take part in the diagnosis missions for regulatory and legal frameworks for the financial inclusion of remittance clients.

CEMLA. It is the Program's execution agency that created the Program Coordination Unit (PCU). Additionally, several CEMLA officers and areas support the Program in terms of payment and financial inclusion systems; publications, revision, edition and preparation; data base development, maintenance and updating as well as in administrative, accounting and budget follow-up processes.

Program Coordinator Unit (PCU). A Program Coordinator and Administrator make it up. Also, two senior economists from CEMLA experts in remittances, migration and balance of payments contribute to the Program together with other two CEMLA economists focusing on the remittance databases management, update and production. IDB/MIF appointed personnel must pre-approve the engagement of external consultants.

During the Program's execution and upon reception of an application requesting for the development of diagnosis and technical assistance, the PCU will coordinate with the appointed personnel and IDB/MIF representatives at the Country's Office so as to identify collaboration areas before, during and after the development of such activity in the country. Likewise, a virtual meeting will be conducted at the beginning of the execution so as to submit the details relevant to this process to the IDB/MIF representatives at the country's office.

The Program's coordinator will make up a team of international experts where representatives of CEMLA, IDB/MIF, IDB's CMF Division will participate together with experts from other institutions* that may be interested in contributing with their technical support on the issues of interest for the corresponding country.

Meetings and Reports

PCU members will gather on a regular basis as needed so as to make sure coordination flows smoothly

and in an efficient manner for the development of activities and the accomplishment of the goals set

by the Program. Contact between them will be permanent and all members are invited to take active

part in all activities conducted, trying to take the maximum advantage of their knowledge and

expertise with regards to subjects covered by the Program*.

Assessment

All knowledge products derived from the Program should be consistent with the Program's objectives and the needs stated by all audiences therein.

At least one year before finishing the Program's enforcement period, a Sustainability Workshop will be conducted with both, representatives from IDB/MIF and the enforcing entity together with others that may be agreed upon in order to assess the progress made and identify the necessary measures and actions to assure continuity of steps already undertaken once the Program funds are up.

At the end of the Program, the PCU will conduct a closing Workshop with the participation of the enforcement agency and IDB/MIF representatives, as well as beneficiaries thereof among others. Such workshop will conduct an evaluation on the Program's achievements, the lessons learned from it as well as best practices identified along the way.

* Members of the Advisory Committee may also take part in it to support the Program's activities.

Advisory Committee

The Advisory Committee aims at providing strategic direction to the Program, providing with recommendations that will contribute to attain the expected goals. Recommendations will go on the following areas:

- Enforcement

- Assessment

- Alliance creation

- Sustainability

- Other areas that may be considered as pertinent

Delimitation of activities

The Advisory Committee will have a strategic role, counseling the Program Coordination Unit (PCU) in strategic terms and in turn, extraordinary situations as follows:

- Changes in the type of information gathered by the government authorities including central banks;

- Changes in a Program component if failing to reach the indicators set;

- Changes in the PCU's personnel.

It will not be necessary for the Advisory Committee to participate in operational decisions with regards to the Program, such as the engagement of consultants outside the PCU, definition of knowledge products, programming and development of activities.

Members

At least 4 members will make up the Advisory Committee, including:

- At least one CEMLA top-management representative

- At least one CEMLA expert in remittances, financial inclusion and balance of payments who may not be directly related to the Program on a daily basis;

- At least one IDB/MIF person expert in remittances, financial inclusion and balance of payments

- At least one expert in the remittance, financial inclusion and balance of payments expert from other multilateral organizations, including the Bank Supervisors in the Americas Association (ASBA in Spanish) and the World Bank.

Meetings

Periodicity. The Advisory Committee will gather every six months the latest thirty days after filling up and sending the half-year report to MIF on the Program's advance (PSR). The Advisory Committee, PCU or IDB/MIF may call upon to extraordinary meetings.

Format. The Advisory Committee meetings will last one hour and will be conducted by means of audio/video conferences.

Invitation. These meetings will be called upon by email with a month notice. At least one week before the meeting, the Program Coordinator will share the agenda proposed to the Advisory Committee members who may include their suggestions in it.

Program Coordinator's Task. The Program Coordinator will be in charge of inviting to ordinary and extraordinary meetings, prepare and share with the Advisory Committee members the agenda to be followed at every meeting, including the following: (i) reports on the Program's advance (PSR); (ii) Faced challenges; (iii) Opportunities; (iv) Lessons learned; and (v) Goals to be attained within the 6 months previous to the next Committee meeting. Moreover, the Coordinator will keep record of the items agreed upon in each meeting (minute) and will provide the corresponding follow-up to recommendations provided.

Assessment. The Program's Coordinator Unit, including the intermediate and final assessments, will evaluate the Advisory Committee's activities and recommendations at least twice along the Program. The evaluation will be focused on determining to which extent has the Advisory Committee contributed to a successful enforcement thereof as well as to make valuable strategic recommendations in areas such as enforcement, evaluation, alliance creation and sustainability.

Consulting Group

With the aim at fostering the participation on this Program's implementation from different actors and common interests within the remittance and financial inclusion area, a Consulting Group (CG) will be established that will allow to take advantage of existing networks and alliances in each one of the AC participant agencies and will look to have the participation of experts providing counseling and guidance, contributing with their international experience related to the Program including it in all their different initiatives and activities. The foregoing will also reduce the duplication of efforts with regards to the implementation of Programs related to the subject that are promoted by each one of these agencies in a particular manner. It aims at generating synergies among its participants and the Program, attaining scale economies and a more efficient usage of funds allocated to these subjects.

Members

The CG will be made up by inviting the different international organizations, agencies, institutions and experts suggested by the Advisory Committee and the Working Group who will be asked to appoint one or more representatives in statistics and/or financial inclusion subjects to help as link/participant in the Program.

Such institutions and people will receive the invitations to participate in the different events conducted and in turn, make presentations on their matter of expertise. Likewise, they will be informed of the activities planned for the Program on a regular basis so as for them to identify possible items of collaboration with the Program and derived activities.

Activities

The CG members will contribute to the Program by means of different mechanisms subject to their possibilities, offering their participation and collaboration for each particular case as follows:

- The Evaluation missions and other technical assistance activities provided to the countries for the implementation of recommendations that may arise, also helping to identify and eventually provide additional resources for technical assistance that may support the Program's objectives.

- Program's events and meetings.

- Other ways of collaboration that may derive from CG members will be taken into consideration and coordinated with the Advisory Committee (AC) which may include the joint publication of documents or other publications from CG members as well as other means of collaboration that may come from this group and the Program.

Meetings

These institutions and their representatives will be invited to participate in all meetings and activities making up the Program. It is expected for them to participate using their own means, which are considered as an additional contribution to the Program. It is expected for the CG members to gather at least once a year during the program's meetings and even more often if necessary. Their participation may be in person or in a virtual manner.

Assessment

The participation of the CG members in different activities in the Program will be assessed by the AC and the coordination office with the aim at determining other means of collaboration with these members and the inclusion of new institutions in this group based on the requirements and needs the Program may bring about.

Remittance and Financial Inclusion Working Group (RIWG)

The working group organizes the beneficiaries and the main interested parties along the Program's objectives for them to gather on a regular basis so as to assess the program, suggest actions, file technical assistance applications or offer help, publications or participation in connection with the program's objectives.

Members

The working group is made up by central bank representatives and other authorities of each country taking part in the remittances and private sector financial inclusion matters.

Central banks. The RIWG is made up by two representatives appointed by regional

central banks taking part in the Program. One of the representatives works in the financial

inclusion subject and the other one in the remittance data gathering and disclosure area.

Other authorities. The RIWG also includes representatives of other authorities based on the RIWG members' recommendations corresponding to central banks in each country who, based on their experience and work, propose the institutions that should be included in this group and coordinate the invitation and incorporation of the relevant representatives.

Private Sector. Moreover, the RIWG includes private sector representatives from the suggestions made by RIWG, AC and members of the coordination unit who based on their experience may identify the main actors in the market so as to decide their incorporation in the program. These members are invited by the PCU subject to recommendations and coordinating with the proposing members.

Activities

The RIWG participants are beneficiaries from the disclosure and experience exchange events. Also, they are the counterpart in each country where diagnose missions take place and recommendations are implemented. It is important for the Work Group to contribute to a better regulatory and data gathering frameworks. In this connection, central banks and other authorities participating become the main partners so as to implement the improvements expected to be attained after the program.

Meetings

This group will be called upon at least once a year to attend meetings where the project's development will be discussed as well as the future needs and plans. Additional meetings may be organized subject to the member's needs and definitions. The funding to attend these meetings will be at the corresponding institution's expense. In order to identify the needs both, of the authorities and the industry, the central bank representatives will maintain close communication with the statistics institutes, financial superintendencies and other control and oversight bodies, ministries or secretariats as well as other public agencies related to this matter together with remittance market private sector representatives including private banks, money transfer companies, technology service companies and other entities in the market. These institutions will also be invited to attend annual meetings organized by the Program.

Besides annual meetings, the enforcing agency may maintain constant and open communication with the RIWG members so besides being empowered by the project, they may find it a way to satisfy their own needs and a channel to implement the recommendations that may arise.

Assessment

The participation, requirements and proposals of the RIWG members in the different activities in the Program will be assessed by the Coordination and the AC in order to establish the best manner to cover the needs and determine the collaboration strategy with these members.

RIWG members

-

Tatiana Quiroga Morales

Banco Central de Bolivia -

Rubén Aguilar Cruz

Banco Central de Bolivia -

Francisco Ruiz Aburto

Banco Central de Chile -

Angel Bernal Laverde Molina

Banco Central de Costa Rica -

Jorge Moncayo

Banco Central de Ecuador -

Gabriela Escudero

Banco Central de Ecuador -

Carlos Andrade

Banco Central de Ecuador -

Hurtado de García Xiomara Carolina

Banco Central de la Reserva de El Salvador -

García Monge Jose Luis

Banco Central de la Reserva de El Salvador -

Silvia Verónica Matute Chavarría

Superintendencia del Sistema Financiero (El Salvador) -

Walter Elías Rodríguez Flamenco

Superintendencia del Sistema Financiero (El Salvador) -

Karla Isabel Enamorado

Banco Central de Honduras -

Geizzer David Nuñez Netka

Banco Central de Honduras -

Melanie Williams

Bank of Jamaica -

Larene Samuels

Bank of Jamaica -

Alejandrina Salcedo

Banco de México -

Milton Vega Bernal

Banco Central de Reserva del Perú -

Ramón A. Rosario. G

Banco Central de la República Dominicana -

Rafael E. Capellán Costa

Banco Central de la República Dominicana -

Charlene Ramdhanie

Central Bank of Trinidad y Tobago -

Alfredo Van Kesteren

Banco Central de Venezuela

Recipients of the Program

The direct recipients of this Program will be the central banks, supervisory entities and other relevant entities of the LAC region that will receive support through the execution of diagnostics and technical assistance with the objective of creating an enabling environment for the financial inclusion of remittance customers. Likewise, other authorities will benefit. Although they do not receive support for the diagnostics and technical assistance, they will participate in events of exchange of experiences.

Indirect recipients will be private sector institutions in the remittances market, which will be able to expand their customer base by offering new services to the population that send and receive remittances. Remittance customers will also benefit from greater access to accounts, credit and other means of payment. The remittance clients to be benefited correspond to the population of low income and low average income, of which 50 percent are expected to be women and 50 percent men.

Collaboration with the IDB Group. This Program is coherent with the IDB's objective of supporting economic growth and poverty reduction in LAC by helping central banks and other relevant authorities to improve transparency and develop a regulatory framework that facilitates the development of financial products and services tailored to remittance clients, helping to reduce the economic vulnerability of this population. The implementation of this Program will be done in coordination with other relevant areas of the IDB, including the Division of Capital Markets and Financial Institutions (CMF).

Best Practices and Recommendations on Remittances and Financial Inclusion

- Diagnosis Framework for the Regulatory, Legal and Information Areas

Application for Technical Assistance Missions

The beneficiaries, authorities and other members may request activities and products of the program in this section.

Steps to undertake:

- Send an application letter to the Program Coordination, including the representatives and contacts for the coordination required.

- The terms of reference (ToR) will be drafted in coordination with the representatives and the Program Coordination, stating among others, the objectives, scope, place, date, schedule and participation of the different entities, companies, economic agents as well as public and private institutions to be included in the mission.

- Participants in the mission will include an international team made up by the Program Coordination and the international experts to be defined for such purposes as well as a local team as counterpart, the members of which will be determined by the requesting institution.

- The mission costs and that of products derived therefrom may be covered by the Program, the applicant or both, subject to what may be defined in the Terms of Reference.

- Products in the survey will be subject to the revision, supervision and approval of the Program Coordination as well as that of beneficiaries and applicants. They will include a confidential report directed to the local authorities and a public report drafted and published under the supervision and approval of the applicant authorities.

Application for Surveys on Remittances and Financial Inclusion

The beneficiaries, authorities and other members may request activities and products of the program in this section.

Steps to undertake:

- Send an application letter to the Program Coordination, including the representatives and contacts to coordinate the survey.

- The terms of reference (ToR) will be drafted in coordination with the representatives and the Program, stating among others, the objectives, scope, place, date, schedule and participation of the different entities taking part in the activity.

- The costs derived from the survey and the products that may arise may be covered by the Program, the applicant or both.

- The survey's products will be subject to revision, supervision and approval by the Program Coordination as well as by the beneficiaries and applicants.

Application for Seminars, Courses, Workshops

and Sensitizing Events

The beneficiaries, authorities and other members may request activities and products of the program in this section.

Steps to undertake:

- Send an application letter to the Program Coordination, including the representatives and contacts to coordinate the activity.

- A working agenda will be drafted in coordination with the representatives and the Program Coordination stating, among others, the objectives, scope, place, the estimated time for the event to last as well as the task division between the institution and the Program.

- The requesting institution may provide the venue of the event. Other costs that may arise may be covered by the Program, the applicant or both, subject to the stated on the terms of reference (ToR).

- The participant's invitations and registration will be conducted by the Program Coordination. Guest institutions should pay for their representative's travel expenses.

Request for publications

The beneficiaries, authorities and other members may request activities and products of the program in this section.

Steps to undertake:

- Send the Publication Proposal to the Program Coordinator, stating the relevant contacts for coordination purposes.

- The proposal will be submitted to an assessment committee in order to decide the document's publication's feasibility as well as the means and formats to be recommended accordingly.

- CEMLA's edition area will revise and communicate its remarks to the document's issuer for publishing purposes.

The translation, edition and publication costs that may arise will be covered by the Program, the applicant's entity or a combination of both according to what may be defined with the Program Coordination.