Financial Information Forum

FIF activities have a diverse scope, and according on their nature, they will seek to: (i) exchange experiences and knowledge among members, (ii) promote analysis and debate of issues and joint projects with a regional perspective; (iii) encourage joint learning with international organizations and CEMLA technical associates; and (iv) strengthen capacity and knowledge of the members through training. Based on these pillars, the FIF work agenda can be divided into three scope areas:

- Research and analysis of policy and recommendations;

- Training and dissemination;

- Technical assistance

Activities

-

X Meeting of the Financial Information Forum

May 28 - 29, 2024, Mexico City, Mexico. -

IX Meeting of the Financial Information Forum

Hybrid format, May 30–31, 2023. Lima, Peru. - VIII Meeting of the Financial Information Forum

Virtual format, May 24–26, 2022. Mexico City, Mexico. - VII Meeting of the Financial Information Forum

Virtual format, May 25–27, 2021. Mexico City, Mexico. - VI Meeting of the Financial Information Forum

Virtual format, May 27–29, 2020. Mexico City, Mexico. - V Meeting of the Financial Information Forum

May 28–29, 2019. Lima, Peru. - IV Meeting of the Financial Information Forum

May 28–30, 2018. Madrid, Spain. - III Meeting of the Financial Information Forum

October 4–5, 2017. Santiago, Chile - Technical cooperation activities between FIF members

July 2016. Mexico City, Mexico. - II Meeting of the Financial Information Forum

May 4–7, 2016. Lisbon, Portugal. - Workshop on Assessing International Capital Flows After the Crisis

July 24, 2015, Rio de Janeiro, Brazil - I Meeting of the Financial Information Forum

June 8–9, 2015. Mexico City, Mexico. - Meeting on Financial Information Needs for Statistics, Macroprudential Regulation and

Supervision in Central Banks of Latin America and the Caribbean

May 15–16, 2014. Mexico City, Mexico.

Background

The global financial crisis (GFC) posed different challenges for central banks' functions and objectives to maintain price stability and preserve the health of the financial system.

Among these challenges, it was evident the need for increased available and detailed information on financial systems to understand and analyze in an opportune and proper way its interactions with the macroeconomic stability and the mechanism of monetary policy transmission. Worldwide, the GFC unveiled gaps in financial information that impeded detecting timely risks on economic sectors and financial systems' participants, thus stressing the importance of this strategic asset for central banks in their financial stability analysis.

This scenario demands central banks to improve the methodological, conceptual and analytical framework for collecting, producing and using economic and financial statistics coherently with new needs posed by the GFC, in order to ensure that information is timely, reliable, and transparent so far as in enabling a proper identification of risks in and among real and financial sectors.

Dimensions to overcome this challenge are diverse and may involve significant costs and activities for central banks, in response several international initiatives and task forces have been created to identify and solve core issues to improve financial information on a global scale.

In October 2014, the Center for Latin American Monetary Studies (CEMLA), with approval from its Board of Governs, established the Forum of Financial Information of Latin American and Caribbean Central Banks (hereinafter the Financial Information Forum-FIF) as a regional response for central banks' needs in identifying, monitoring and discussing common issues related to the improvement of financial information models in line with international efforts made in this field.

Objective

The Financial Information Forum aims at strengthening the financial information models of Latin American and the Caribbean central banks, and thus contribute to: 1) improved the analytical capacity for monetary policy and suitable macroprudential regulation and supervision; 2) harmonization of national financial statistics in light of the major financial integration and interconnectedness across the Region; and primarily 3) foster technical collaboration among the Forum members for the debate of relevant issues, international standards and recommendations, seeking its adoption into the Region's financial information models and systems on a thoughtful way. This will be achieved by:

- Identifying key features of Latin American and Caribbean central banks' financial information models, comprising main regulatory, institutional and operational needs and differences influencing the use and management of the data.

- Promoting the overall enhancements in the use, practices, management and governance of the financial statistics within the Region, aiming at addressing identified gaps and needs according in each jurisdiction, in line with international efforts made in this field.

- Capacity building of strategic areas within the central banks for the management and use financial information, via technical assistance and training.

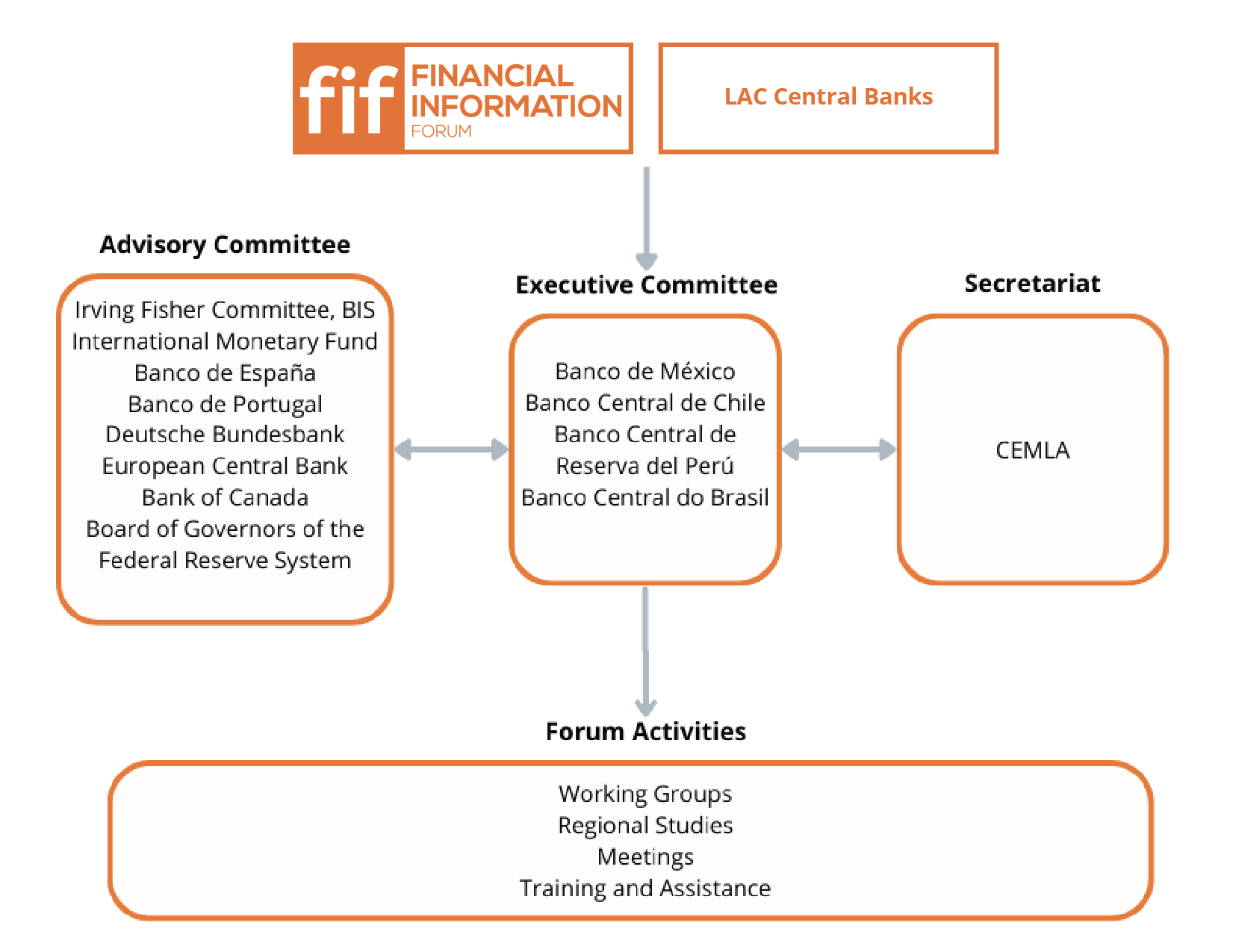

The Financial Information Forum comprises representatives from Latin American and the Caribbean central banks and other CEMLA collaborating members, including extra-regional central banks and major international financial organizations, responsible for the management and use of the financial information systems at their respective institutions. The governance of the Forum consists of a permanent Secretariat, the Plenary (or the Forum itself) and an Executive Committee.

Plenary

The Plenary encompasses institutional members designated by each Latin American and Caribbean central bank and other CEMLA collaborating members. Their main duties include:

- Defining the strategic orientation and the agenda based on the review of needs, resources and priorities of the membership;

- Being active participants of the different Forum's activities, either by taking part or coordinating specific tasks, or proposing the inclusion of new issues or activities to be addressed by the Forum, or providing specific technical assistance to other members, among others activities; and

- Attending the annual plenary meetings and other related remote and in-person meetings carried out as part of the Forum's activities and promoting the participation of their staff in said activities (e.g. training, seminars or conferences).

Executive Committee

The Executive Committee is a coordinating body made of 3–4 members, one of them acting as Chairperson. Committee members will be elected by the Plenary for a term of two years with the possibility of being reelected and having overlapping terms to ensure the continuity of the Forum's activities. Geographical representativeness is desirable in the composition of the Committee and each member must have the necessary institutional support to carry out the following tasks:

- Being responsible for implementing and managing the agenda and related activities of the Forum;

- Promoting effective cooperation and regular communication among the members in order to ensure the activities and the agenda of the Forum are properly developed, and to keep informed the members about important FIF matters;

- Maintaining permanent communication with the Secretariat and the Advisory Committee as supplementary support and guidance for any of the Forum's activities that may be benefited from their expertise;

- Taking responsibility of specific activities upon proposal of the Plenary in affairs that may merit priority and require immediate attention of the Forum;

- The Chairperson, in particular, will be responsible of the contact with international bodies and initiatives that are relevant for the Forum, thus her/his experience in international central banking issues is an important asset; and,

- Providing the greatest dissemination to the work of the Forum in coordination with the Secretariat.

Secretariat

The FIF Secretariat will be permanently hosted by CEMLA and its main responsibility will be to ensure the proper functioning of the Forum's agenda and activities by supporting the Plenary and the Executive Committee. Other particular tasks of the Secretariat entail:

- Maintaining record of any Forum’s affair, activity, correspondence and other relevant event, this includes the responsibility to disseminate in electronic channels the publications and releases emanating of the FIF work;

- Liaising with international groups and organizations, including the Advisory Committee, to foster the visibility of the Forum in the international community;

- Taking responsibility in specific matters upon proposal of the Executive Committee or the Plenary, as it can be the organization of the annual plenary meetings, conferences, training, and technical assistance, among other activities;

Acting temporarily as the Forum´s coordinating body in case the Executive Committee is dissolved or unable to fulfill its duties.

Advisory Committee

The Advisory Committee is a supporting arm of the Forum formed by representatives from international organizations and extra-regional central banks that are well-known in the international statistical community. The main functions of the Advisory Committee members relate to:

- Supporting the Executive Committee and the Secretariat to keep updated the Forum's agenda in line with international statistical developments;

- Providing advice or specific support to FIF activities upon request of the Executive Committee or the Secretariat, including technical assistance, direct contribution for groups set by the Plenary, among others; and

- Attending the annual plenary meetings and other related remote and in-person meetings carried out as part of the Forum's activities.

Central Banks

- Banco Central de Bolivia

- Banco Central de Chile

- Banco Central de la República Argentina

- Banco Central de la República Dominicana

- Banco Central de Reserva de El Salvador

- Banco Central de Reserva del Perú

- Banco Central do Brasil

- Banco de la República (Colombia)

- Banco de México

- Central Bank of The Bahamas

- Central Bank of Trinidad and Tobago

- Centrale Bank van Suriname

Advisory Committee members

Steering Committee (2021–2023)

- Chair: Banco de México

- Co-chair: Banco Central de Chile

- Co-chair: Banco Central de Reserva del Perú

- Co-chair: Banco Central do Brasil

Secretariat

CEMLA

Financial Stability Directorate

Tel: +52 (55) 5061 66 40

E-mail: fif@cemla.org