Intermediate Meeting of the Working Group of the Joint Research

August 5 and 6, 2019, Mexico City, Mexico

Welcome and Opening Remarks, Manuel Ramos-Francia

It is difficult to overstate the importance of fiscal policy. In effect, it has a long history. For instance, taxes go back to, at least, the middle ages. The word in Spanish 'impuesto' directly denotes that taxes are an imposition. Similarly, to tax comes from the old French taxer, which means to "impose a tax." The feudal lord would send his tax collectors accompanied by some guards, else, the implications became a matter of life and death.

Fast forward to the XX century. One of the key objectives of fiscal policy was the management of aggregate demand. In the past decades, at least once, there has been the perception that the business cycle problem had been solved (Lucas, 2003). Needless to say, the Global Financial Crisis proved otherwise.

A general challenge for an EME is managing its fiscal and monetary policies. In the present juncture, this largely means how to deal with external financial shocks. One needs to determine the most suitable aggregate demand structure to absorb shocks, given a specific scenario. In this context, there are three margins to consider: i) public-private; ii) internal-external; and, iii) consumption-investment. The fundamental prices are the real exchange rate and the real interest rates.

There are three sources of potential financing for a government. i) The central bank ii) the fiscal authority; and, iii) multilateral international agencies. From the fiscal perspective, there might be two type of problems. The first problem is a flow one. Its solution commonly involves the modification of the macroeconomic policy stance. In some cases, such a modification might be used as a signaling device. In short, it would not solve the fiscal problem at hand, but it is crucial in order to signal a commitment. The second one is a stock problem. A stock problem commonly grows unmanageably fast and, thus, a country will very unlikely solve it. In the case of an EMEs, it commonly involves the participation of a multilateral international agency.

Similarly, there are three challenges in the implementation of the referred policies.

- The common macroeconomic management.

- A stock crisis. In the case of an AE, it might be able to implement a program along the lines of the TARP (Troubled Asset Relief Program). For EMEs, it will need to obtain external financial aid.

- The third one is a combination of ii) and iii). For example, the demographic dynamics put pressure on the fiscal accounts. This is mainly unrelated to a business cycle issue, and it is not necessarily a stock problem.

For a typical economy, the lines of defense at its disposal are: i) conventional monetary policy, which, for some, it might give place to ii) unconventional monetary policies. Afterward, the fiscal policy plays a very relevant role. This was particularly the case for several AEs. We all very well remember the challenges in southern Europe circa 2010.

As a more active fiscal policy is implemented, the eventual obliged question will be on the fiscal space. Given the new fiscal policy expected path, what is the available fiscal space? In other words, given the need of a significant change in the present fiscal policy, questions on its sustainability will be brought to the table.

In this context, two cases in point were the following. Many had the perception that EMEs should strengthen their fiscal policies, in particular, as AEs were dealing with their own problems at the time. This made sense as EMEs faced relative less difficulties during and after the GFC. Second, for example, there was an argument for Germany to have a more active fiscal policy. The rationale was direct. Germany had a very solid fiscal position and, arguably, expanding its fiscal policy could 'support' the recovery of other economies.

Tests on debt sustainability have focused on the statistical properties of fiscal variables. The initial tests were, for the most part, statistical. For instance, tests on the presence of unit roots in the associated time series. Other tests focus on assessing whether the present value of net income was greater than the present value of debt. While informative, it is limited to just focus in the econometrics tests. One needs to consider further equally important issues. To name a few, fiscal expenses entail considerable negotiations between several coalitions of groups. The problem is that, more often than not, counterproductive equilibriums are very stable.

There are three main sources of fiscal finance for a government: tax revenues, non-tax revenues, and debt issuance. Once these come to a halt, a government can either obtain resources through seigniorage or default. This is partly the logic of in the seminal paper of Sargent and Wallace (1981).

One way of exploring the relationship between monetary and fiscal policy, is considering the seigniorage-financed fiscal deficits. This can be done following Sargent et al. (2009). Their model has the following elements. There is the demand for money. Then one needs to think about the formation of inflation expectations. The government budget constraint, which could include seigniorage as a possible source of income. It can be useful to assume that the distribution of the fiscal deficits depends on a regime-switching process. Such a process can affect the mean and volatility of the fiscal deficit distribution. To estimate the model´s parameters, one can use the inflation time series. In the process, one estimates the regime that is affecting the fiscal deficit distribution in the period at hand.

Ramos-Francia took the opportunity to announce the forthcoming journal of CEMLA, the Latin American Journal of Central Banking. Central banking as a subject is not limited to monetary policy. On the contrary, it entails several other subjects, more so as the responsibilities of central banks have increased. In effect, the subjects that fall under central bank have expanded. Being more specific about the journal, he underlined that CEMLA will pay very keen attention to the refereeing process. The journal represents a substantial opportunity for researchers in central banks of the region, as it will attend a specific research niche. We believe that such niche has not been covered. To conclude his opening and welcome remarks, he wished everyone a very productive meeting.

Invited Lecture, Better Spending for Better Lives How Latin America and the Caribbean Can Do More with Less, Alejandro Izquierdo

Alejandro presented a research project for which he was one of the main authors. In it, he studies one key component of fiscal policy, namely, government expenditures. He focused on the Latin American and Caribbean region. The context can be broadly described by three elements. First, a growing middle-income class, which is demanding more government services. Second, the deterioration of external conditions, which could affect the economies in the region in several ways. Third, several countries have sought domestic sources of growth.

Public spending in the region´s largest economies has increased by a factor of 8.2% of GDP in the past 25 years. For several economies, the government expenditures increment from 2007 and 2014, adversely affected their primary fiscal deficit gaps. Considering 1980 as the initial date, the current expenditures´ trend has been positive, and that of capital expenditures has been negative. Prominently, the expenditure´s multipliers differ depending on the type of expenditures. The current expenditure multiplier is around 0.2, while the capital expenditure multiplier can reach 2. The allocation of current and capital expenditures has led to a lower multiplier. Consequently, the government expenditures´ paths seem to have turned costly for the region in terms of the lost economic growth.

In terms of resources´ allocation toward different age groups, the bulk has gone to senior citizens in the form of social protection. Resources toward education favor young groups, particularly so, those in the 5 to 9-year range. Health related expenses increase uniformly after the 5 to 9-year group, providing seniors with the largest share.

Several patterns are unlikely to improve in the near future, and some will deteriorate. For instance, the relative allocation of resources to senior citizens will increase in the years to come, on average, by a factor of two. In terms of the returns to education, investing in different educational programs one obtains markedly different results. We have that those allocated to pre-natal and 0-3 age group reap the highest returns. This is a particular case of a more general study by Heckman (2006). Thus, the allocation described in the last paragraph seems to be suboptimal. The relationships between central and local governments are characteristic in many economies. Local governments spend much and collect little resources. In addition, local governments are less efficient.

As a way of conclusion, given the factors mentioned above, what could affect economic growth? We have that, positively, capital expenditures and improvement in the quality of human capital. On the other hand, economic growth is negatively affected by excessive expenditures and a lack of good management.

Then, he went on to demonstrate us some estimates on the potential gains from addressing three issues. He underscored three. First, there are leakages when transferring resources. Second, there is waste in procurement of goods and services. Third, there are wage bill inefficiencies. In sum, they estimate a gain of 4.4% GDP if all three issues were addressed.

In addition, his paper documents a wage gap of 23% between the public and private sectors. This might be a problem to the extent to which allocation efficiency does not line up with wages. This is would happen if the more productive persons are not allocated in the public sector.

Transfers appear to involve three further inefficiencies. First, transfers tend to fall in bad times. Second, social security systems are typically indexed to wages. Third, there is small spending on unemployment insurance. Thus, transfers appear to be negatively affecting a risk-sharing mechanism present.

When it comes to infrastructure, there are significant costs in terms of overruns and delays. This is particularly important, as mentioned, as increases in capital expenditure leads to higher multipliers. Alejandro Izquierdo estimates that in terms of overruns, there is a loss of 0.7% of the regional GDP. In addition, delays seem to lead to losses adding to 0.5% of the regional GDP.

What can be done to improve efficiency in education? He gave three recommendations. Teacher numeracy and literacy skills should be enhanced. Parents should have a choice on which school they send their kids to. Good teachers should be paid a premium. However, he did mention some of the factors that are hindering a more efficient educational process. The bulk of the educational expenses go toward wages. The standardization of school content seems to be counterproductive.

The impact of transfers and direct taxes on inequality. In Latin America, inequality decreases in 4.7%. As a reference, consider that OECD and EU reduce inequality by 38%. It is difficult to understand why this is the case, still, many transfers favor top percentiles. In effect, contributory pensions and subsidies are regressive. On the other hand, noncontributory pensions and conditional cash transfers are progressive. Moreover, the first two items account for 75% of the resources transferred.

A key recommendation is to build trust. An equally relevant recommendation is to promote fiscal rules that protect investment. This is a result of the findings above. The following elements can be underscored: strengthen institutions for allocative efficiency; prioritized strategies; and, the implementation of fiscal and productivity councils.

Alejandro presented a case on building efficient institutions. He illustrated how improving procurement led to several gains in different sectors. For example, he documents a 47% drop in under five years old mortality, a drop of 30% in violent crime and a 17% increase in PISA scores, among other improvements.

As more general recommendation, he underscored three points. First, public investment should be protected. It seems to be one of the first components affected under adverse circumstances. Second, investing in human capital. Third, avoiding inefficient transfers.

Further Remarks by Manuel Ramos-Francia

One needs to pay close attention to fiscal financing, in particular, to components such as public-private and off-budget vehicles**. Much care has to be taken care, as they might be a way of sidestepping fiscal limits.

In modifying fiscal policy to address a possible distortion one needs to remain vigilant. Suppose that a country collects a tax and provides a subsidy to those affected by the tax. Removing one might leave everyone worse-off. This is a particular case of the Second-Best Theorem.

A challenging part of macroeconomic management when the need to tighten fiscal policy comes is to deal head on with current expenses. This is because, commonly, capital expenses are those that are cut, but from the macroeconomic point of view, this might be problematic.

Institutions are central. For instance, one needs to assess the incentives faced by elected officials. This involves considering the political cycles as they typically are unrelated to the economic horizons. In this context, the presence of councils and/or rules can be helpful. Nonetheless, councils, as we presently know them, might pose a representation problem.

Prescriptions need to be concrete. One should avoid abstractions and/or idealizations. In addition, a persistent problem in this regard is that of the presence of coalitions and their incentives. The political economy of coalitions tends to lead to stable and perverse equilibriums. He made reference to Rajan (2009) as an example of such an equilibrium.

There are several issues surrounding the topics of efficiency, growth, and redistribution. For instance, there are some new technologies that could make production less labor intensive. Policy is urgent in this regard. We need programs to close the gap in the production processes (automatization process) and perhaps to be prepared for further potential changes.

§

In what follows, a brief summary of the contents of each presentation is provided. Please see the program of the event for details.

Guatemala

Given its institutional arrangement, when debt sustainability is assessed with standard or traditional methods, few concerns arise. Having said that, public underinvestment is a significant concern. In addition, low government revenue remains a key challenge. In their paper, they focus on a method that focuses on revenue uncertainty (Mendoza and Oviedo, 2004).

Mexico

Mexico have presented an increase in its public debt in the past years. There are pressures on public finances, which could jeopardize the public sector capacity to honor all of its obligations. It becomes necessary to obtain a medium-term public finance sustainability. The primary balances path planned by the authorities would be consistent with a sustainable situation in the medium-term.

The scenario depends on the fulfilment of the annual goals of the fiscal balance and, in tandem, on the realization of the macroeconomic framework with which the estimations were constructed. Economic projections need to be based on realistic assumptions. This enables obtaining precision on the expected sustainability of the fiscal policy.

One could make a sustainability analysis with a longer horizon , say, 10 year, to the extent that relevant long-term projections become available. This would allow having a timely diagnostic on public finances.

El Salvador

The public finances of El Salvador have been in a process of consolidation. Its debt is slightly above its natural limit. Nonetheless, the base scenario projections reflect a medium-term convergence to the natural debt limit. In addition, there is a probability of 54% of public debt exceeding its natural limit.

Costa Rica

A declining trend in the debt output ratio signals that government policies are unlikely to jeopardize sustainability. Whereas a positive trend or even stabilization at a high level may lead to concerns about sustainability, especially if other factors point to difficulties in keeping debt under control.

Their results show that there have been some efforts in the short run for debt sustainability but they have been far from the long run needs.

Dominican Republic

Under the estimation of local variables and the assumptions on the paths of external variables and primary balances generated by the public sector between 2018 and 2026, an average primary balance of 0.52% (with respect to GDP) is needed to maintain a stable public debt GDP ratio.

Establishing a goal of 30% for the debt GDP ratio for 2026, the public sector should generate an average primary balance of 4.08% with respect to the GDP.

Uruguay

Uruguay presents an extensive analysis, entailing the debt dynamics for the past 30 years using DSA framework. In addition, they consider a balance sheet approach. They also consider fiscal sustainability going forward, within a 10-year horizon.

We highlight the following pair of results. First, their debt dynamics by factors. In the past 30 years, change in monetary base, output growth, primary deficits, and depreciation-inflation have contributed negatively. On the other hand, interest payments along with 'other factors' have done so positively.

Second, their balance sheet approach takes into account the interaction between different units of the public sector. In addition, it differentiates counterparts such residents and non-residents. Such a difference is important as their responses to different shocks differ.

As future work, the authors highlight the following tasks. First, to estimate an empirical fiscal reaction function à la Bohn (2007). Second, to estimate an empirical equation for the EMBI using fiscal factors. Third, regarding the medium-term analysis to incorporate risk scenarios. Finally, with respect to the medium/long term perspective: include demographic and actuarial data, in particular, its impact on the social security system.

Honduras

Honduras presents a rich statistical data set on fiscal variables. Moreover, it implements two tests. The classical Blanchard test and one of its predecessors, the Talvi-Vegh tests.

Colombia (First paper)

They calculate the debt limit of the Colombian government and other six Latin American governments estimating the reaction function. The critical value should be avoided. Reaching the critical value might lead to sustainability problems. Considering the debt limit and current debt level, they assess the fiscal space.

They estimate the fiscal space under the fiscal fatigue approach (Ghosh et al. 2013). They use cubic splines to obtain the fiscal response function for EMEs. In addition, they endogenize the risk premium. Their results suggest that the public debt limit is around 56% with respect to the GDP. Thus, the fiscal space would be 7%. This space seems small, in particular, given its sensitivity to external shocks.

Chile has a greater fiscal space, low debt and good macro performance. Mexico and Ecuador, which have similar debt levels, and some fiscal space, 5.4% and 1.5%, respectively.

For Brazil and Peru there were not able to estimate the debt limit. Albeit, this was for different reasons. For Brazil, it was because of a high positive spread between the real interest rate and the per capital growth rate. For Peru, it was due to its negative spread.

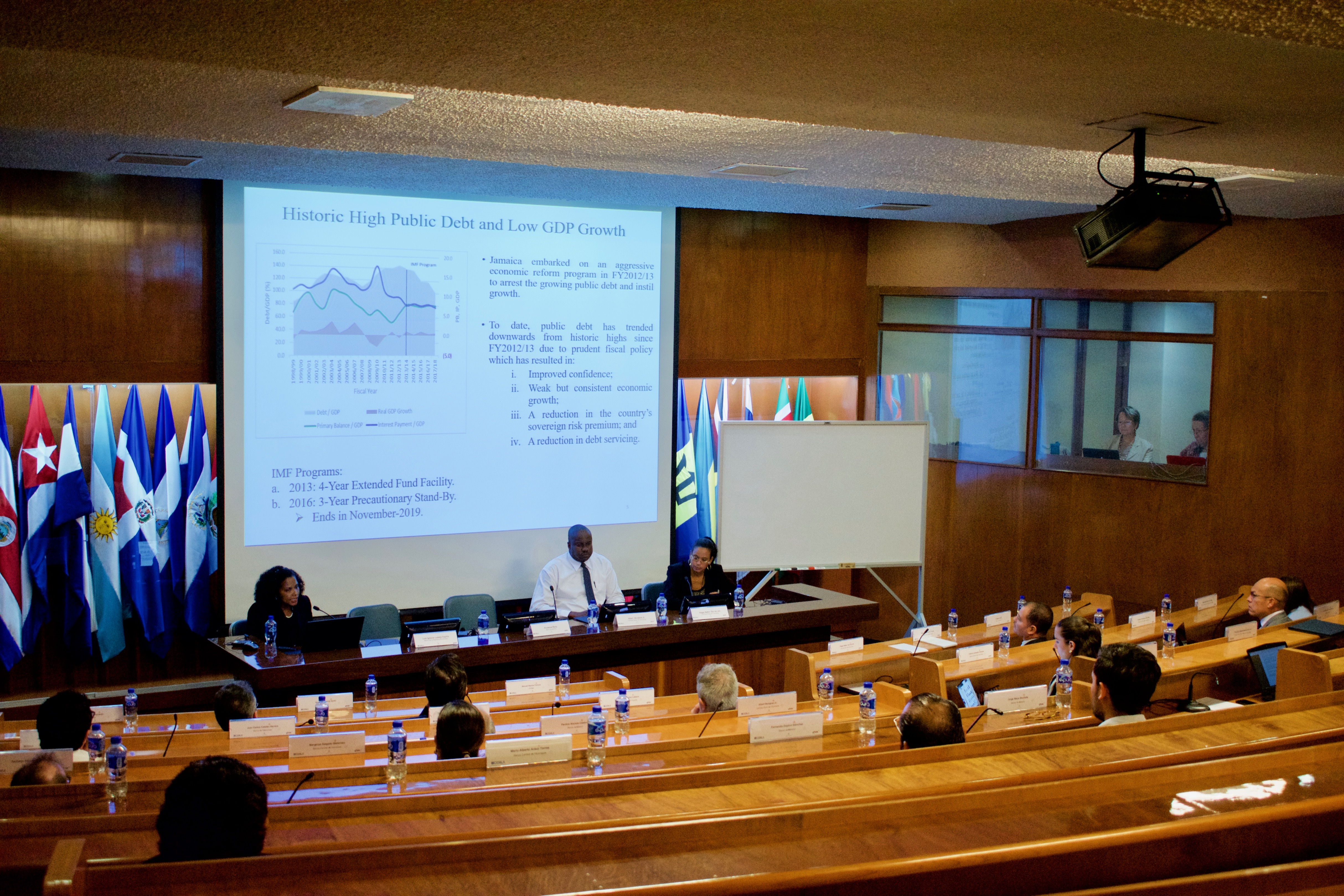

Jamaica

After the active economic reform program, fiscal policy in Jamaica is on a path to achieve sustainability. A strong fiscal institution is required to monitor the Government's performance to ensure that the path to sustainability is maintained.

A long-run primary surplus of 4.8% is required to achieve a debt/GDP ratio of 60%. Jamaica's public debt is most vulnerable to sharp exchange rate depreciations. Foreign currency debt accounts for approximately 60% of public debt. It is critical to rebalance the portfolio in favor of domestic debt. Overall the risk to the public debt stock is high.

Suriname

There was a discussion on the fact that the primary balance maintains much inertia. Inertia of the primary balance seems to last two periods. They find a positive relationship between the primary balance and lagged debt, and a non-linearity between primary balance and lagged debt. Although the interest-growth differential rule indicated a sustainable fiscal policy, the sources contributing to that sustainability seem to mostly come from negative real interest rates.

Colombia (Second paper)

The actual debt of the central Colombian government is above to that of the 2002-03 levels, a period characterized by fiscal fragility. Quantitatively, 48.4% vs 43.7%. While nowadays it has a better profile in terms of interest rates, currencies and maturity, its sensitivity to external macro shocks is high.

The official forecast is of a debt reduction, but it does not account for risks. In addition, the forecasts were based on some assumptions that would hardly be realized (specifically, in terms of economic growth and primary balance). Thus, they use a VAR to study debt determinants, including risk factors. More generally, given that the variables that determine the debt are stochastic, they consider a sustainability analysis that incorporates risk.

They use a linear VAR to forecast debt determinants as in García and Rigobón (2004). Then they perform semi-parametric bootstrapping to assess the probability that the debt exceeds certain threshold, after which debt would have unsustainability issues. Their results indicate that, under the base scenario, there is a high probability that debt keeps on keeps on increasing in the medium terms (2019 to 2022), overshooting the limit of 52%.

The forecast conditional on the fiscal rule being satisfied, suggests that to reduce the debt level would require a higher growth and a lower interest rates, or taking direct actions as cuts in expenses and increase in the tax rate.

Spain

They estimate a structural Bayesian VAR for five Latin American economies: Chile, Peru, Colombia, Brazil and Mexico. To identify the shocks, they jointly use two approaches. First, assuming that each country has a small open economy, they consider two blocks of variables within the VAR. The intuition is that external variables can affect local ones, but not the other way around.

Second, they use is the so-called sign identification. In such an approach, one considers the whole distribution of a shock conditional on a sign restriction. Then one considers the median of such a distribution. They set restrictions on the output and fiscal shocks. Then, they consider the debt feedbacks.

In short, they compare the IRF of a model without debt and the debt feedback specification. They argue that debt feedbacks seem to present in Brazil and less so in the case of Mexico.

CEMLA

The paper considers several EMEs divided in two groups depending on their average inflation. The group with low inflation, has had lower than median inflation. The group with high inflation has had higher than median inflation. They, the paper performs the Bohn's financial sustainability, as in Mendoza, tests on these groups separately.

The group with a higher than median inflation tends to have their factors priced in the tests, while the group with a lower than media inflation tends not to be priced in their factors. In addition, the first group appears to have lower long-run sustainable debt levels, an issue that deserves further scrutiny.

Guatemala

A positive government spending shock, has a positive effect on output, which lasts on average eight quarters, it then goes down. An increase in tax burden has a negative effect on output, this lasts in average for three quarters. Then, the output returns to its initial position. Findings also lead to support the notion that robust institutions are key to long term and sustained fiscal policy measures.

Dominican Republic

Fiscal Rules are an important step to address the problem of a bias with the fiscal deficit. Not all rules are convenient from the macroeconomic point of view. Debt goal rules based on expenditure adjustment and expenditure goal rules as a % of GDP are the more convenient ones.

References

- Arizala, Francisco et al. (2008). "Debt sustainability Fan Charts: combining multivariate regression analysis and external forecasts". In: Washington, DC, United States: Inter-American Development Bank, Research Department. www.eduardocavallo. com/FC_05_05_2009_EC_FA. pdf.

- Blanchard, Olivier Jean (1990). "Suggestions for a new set of fiscal indicators". In: Borensztein, Eduardo et al. (2010). Template for Debt Sustainability: A User Manual. Tech. rep. Inter-American Development Bank.

- Buiter, Willem H (1985). "A guide to public sector debt and deficits". In: Economic policy 1.1, pp. 13–61.

- Mendoza, Enrique G and P Marcelo Oviedo (2004). Public debt, fiscal solvency and macroeconomic uncertainty in Latin America: The cases of Brazil, Colombia, Costa Rica, and Mexico. Tech. rep. National Bureau of Economic Research.

- Blanchard, Olivier (1990) "Suggestions for a new set of fiscal indicators", Working Paper, OCDE, No. 79, París.

- Talvi, Ernesto y Carlos Végh (2000) "La viabilidad de la política fiscal: Un marco básico", en Ernesto Talvi y Carlos Végh, eds., ¿Cómo armar el rompecabezas fiscal? Nuevos indicadores de sostenibilidad, compilado por Banco Interamericano de Desarrollo, Washington, D.C.

- Sargent, T., Williams, N., and Zha, T. (2009). The conquest of South American inflation. Journal of Political Economy, 117(2), 211-256.

- Heckman, J. J. (2006). Skill formation and the economics of investing in disadvantaged children. Science, 312(5782), 1900-1902.

- Mendoza, E. G., & Oviedo, P. M. (2004). Fiscal solvency and macroeconomic uncertainty in emerging markets: the tale of the tormented insurer. manuscript, University of Maryland.

- Rajan, R. G. (2009) Rent Preservation and the Persistence of Underdevelopment American Economic Journal: Macroeconomics. 1(1). January 2009. pp. 178-218.

NOTE:

* This note was written by Santiago García-Verdú. Please address any comments/suggestions to him. Its contents intend to be a summary of the remarks and/or presentations. No originality is intended. The ideas should be attributed to the remarks and/or presentations and the sources cited therein.

** Pidiregas, in the case of Mexico.

Welcome and Opening Remarks, Manuel Ramos-Francia, CEMLA

Invited Lecture

Public Spending and Fiscal Sustainability ![]()

Alejandro Izquierdo, Inter-American Development Bank

Session 1. Accounting Method and Intertemporal Government Budget Constraint

- Fiscal Policy in Guatemala: Institutional Arrangement and Debt Sustainability

Banco de Guatemala - Fiscal Sustainability in Mexico

Banco de México - Sostenibilidad de la Deuda Pública de El Salvador

Banco Central de Reserva de El Salvador

Session 2. Accounting Method, Intertemporal Government Budget Constraint and Fiscal Reaction Function

- Fiscal Policy in Costa Rica: Sustainability Analysis and Reaction Function

Banco Central de Costa Rica - Sostenibilidad Fiscal en la República Dominicana

Banco Central de la República Dominicana

Session 3. Accounting Method, Intertemporal Government Budget Constraint and Fiscal Reaction Function

- Fiscal Policy: Fiscal Sustainability and Proposals for Institutional Change

Banco Central del Uruguay - Sostenibilidad de la Deuda en Honduras

Banco Central de Honduras

Session 4. Fiscal Reaction Function using National or Panel Data

- Límite de la Deuda Pública y Espacio Fiscal: Análisis para Colombia y Otros Mercados Emergentes

Banco de la República (Colombia) - Fiscal Sustainability and Proposal for Institutional Change: The Case for Jamaica

Bank of Jamaica - Estimation of a Fiscal Reaction Function for Suriname

Centrale Bank van Suriname

Session 5. VAR Method

- Evaluación de la Sostenibilidad Fiscal en Colombia

Banco de la República (Colombia) - Debt Feedback and the Intertemporal Budget Constraint

Banco de España - Fiscal Sustainability and Institutional Change in Nicaragua

Banco Central de Nicaragua

Session 6. DSGE Models and Others

- Debt Sustainability and Monetary Policy Attainment in EMEs

CEMLA - Reglas Fiscales como Alternativas para el Diseño de la Política Fiscal: El Caso de Centroamérica y la República Dominicana

Banco Central de la República Dominicana

Concluding Remarks, Santiago García-Verdú, CEMLA