Disponible en Español ![]()

VI Meeting of the Financial Information Forum

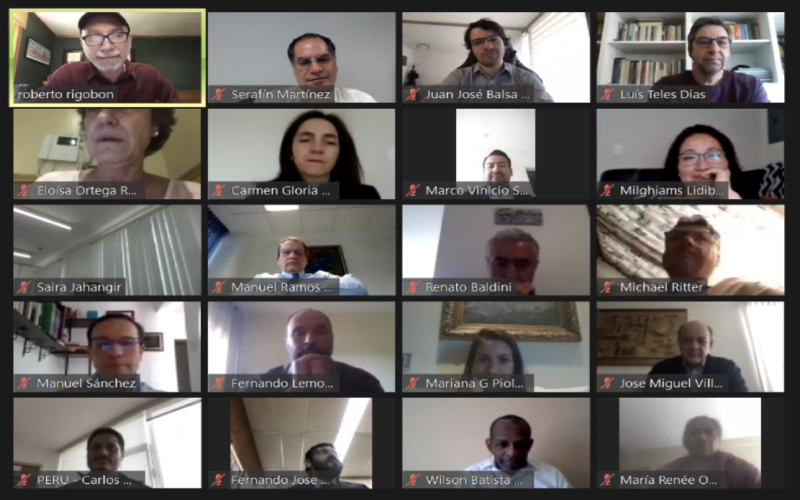

Virtual format

Mexico City, 27-29 May, 2020.

The Forum of Financial Information of Latin American and Caribbean Central Banks (FIF) was stablished in October 2014 by the Center for Latin American Monetary Studies (CEMLA), as a regional response for central banks' needs in identifying, monitoring and discussing common issues related to the improvement of financial information models in line with international efforts made in this field.

Since its implementation, six meetings have been held. The FIF is led by a Steering Committee, currently with representatives of central banks of Mexico, Chile and Peru and CEMLA acts as the FIF Secretariat.

The VI edition of the Forum, was held in Virtual Format, on 27 - 29 May 2020. It was very well attended by 144 representatives from 27 countries from Latin American, the Caribbean and Europe (Argentina, Barbados, Bolivia, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, France, Germany, Guatemala, Honduras, Italy, Mexico, Nicaragua, Panama, Peru, Portugal, Spain, Suriname, Switzerland, Trinidad & Tobago, United States of America, Uruguay and Venezuela), including associates and collaborating members.

The VI Meeting was aimed at sharing regional and international experiences about financial technologies and new information needs, financial information confidentiality and data quality, the use of data science techniques for financial information analysis, and the statistical developments and challenges in Latin America and the Caribbean.

Session 1. Keynote: “New techniques for gathering and analyzing information for monitoring financial and price stability”

Dr. Roberto Rigobón, MIT.

Presentation ![]()

The presentation was entitled Economic Stability and Measurement. Firstly, Professor Rigobón explained how the consumers’ engagement has changed and the way they interact with the virtual world in terms of information and price comparison, price transparency, the erosion of loyalty from the consumers, and how the designing of products and services has changed to be specific for individuals (nano-services), every individual has become a market. He also explained the two very large changes pricing behavior: i) platform prices (prices decision is almost done by an algorithm Robo-pricing pricing, the prices have to change continuously) and the value is on data organization; ii) quantum prices (stores design and group their products and consumers according to their profile) pricing clustering pricing and the value is on price discrimination. Price in fashion retail can move in large quantities and can be very sticky. Quantum prices are defined “as the property of a firm’s pricing strategy of using sparse, clustered, and sticky values to price large and diverse product lines.” Quantum prices affect price adjustment strategies at the firm level and it makes difficult to calculate inflation at macro level.

The presentation continued examining the paradigms on the organization of the data. The presented departed from surveys that provide information on geography and socio-economic conditions, the purpose is to understand what you do, where you are and, preferences. However, this has changed dramatically with the online platforms, now instead of approximate preferences, they measure them, observing audience preferences, profiles, etc. Business does not necessarily get their profits from the products they sell, but from the data, they collect. He also explained the concept of price clustering and its relationship with inflation dynamics.

From there the two important concepts of data generation processes and data gathering were explained. The presenter discussed new data sources: i) digital documentation of transactions with a service or manufacturing process; ii) data from social network communication; iii) data transmitted from software agents within mobile devices; iv) data from the internet of things; v) biometric data; vi) human communication digital data, and vii) digital video data. He also talked about the evolution of data sources from (surveys and administrative) to organic (big data).

Professor Rigobón concluded explaining the Billion Prices Project, online information and indexes system to approach to daily inflation statistics, with the following features: 1) Use scrapping technology; 2) connects to thousands of online retailers every day; 3) find individual items; 4) store and process key item information in a database, and 5) developed daily inflation statistics for 20 countries.2

Session 2. Quality and Confidentiality of data / Data science techniques for the collection and analysis of financial information

Dr. Stefan Bender, Deutsche Bundesbank.

Presentation ![]()

This session was devoted to sharing the international experiences on the implementation of techniques and good practices to preserve the quality and confidentiality of information, in particular from the viewpoint of the Deutsche Bundesbank. The presentation discussed the collection of financial information, the transformation of the way the data collection has changed. Dr. Bender explained why regular data is necessary, but also that aggregated datasets are important for macroeconomic developments and policymaking: Furthermore, granular data is necessary not only in countries but also between countries, but local constraints make difficult to link micro datasets, so better accessibility and sharing of granular data would open up new possibilities for analysis by providing new insights into the effect of policies.

Dr. Bender highlighted the importance of collect data not only for specific purposes instead of multiple purposes, for instance, transform big data to our purposes, which is challenging as well as data protection implications. Technological innovations include standardization, better tools to analyze, and process data among others.

The presentation continued with an overview of the work that the Task of the Research Data and Service Center (RDSC). This center provides access, for non-commercial research, to highly sensitive microdata held in custody by the Deutsche Bundesbank. Microdata for banks, companies, securities, and households are available. The Center also engages in cooperation with universities one of the main reasons to open the data to researchers.

In regards to the new data sources and techniques, the Bundesbank collects the needed data to fulfill different purposes, using more often “additional data sources”. They are also improving data quality with machine learning techniques, He presented how RDSC is starting to i) Establishing standardized data products; ii) implementing RDSC data quality procedures; iii) documentation of data; iv) Harmonization of data; and v) register data to get data identifiers (DOIs).

The Knowledge Life cycle in RDSC was also explained. It was mentioned that from internal to external have established a lot of common rules and procedures, how can improve the data quality from original data, how to find out what researchers are doing with this kind of data, how to connect the future easier, what kind of research is and in what publication, and a backflow. Big data technology is not only having a new data but it’s also a new kind of thinking and working with data, these new techniques need special skills and also new or special ideas.

In the same vein, he continued talking about Data Science for the Analysis of Financial Information, which has two main elements: to enhance data services for users and to justify the added value of microdata for research. He explained why it is important to find the data sets used in publications and how they use two algorithms to find such data sets. Finally, he also defined the Data set impact factor which considers that: i) the more publications using dataset the better, and ii) a broader use of a data set is also better.

Session 3. New participants of the financial system and information needs (Fintech)

Fernando Ávila, Banco de México

Presentation ![]()

Mr. Avila presented the current state of The Fintech sector in Mexico and the latest developments. He also presented what sort of information they are looking for in this sector and the possible data gaps for financial stability analysis and monitoring. The presenter described the different initiatives for closing those data gaps. In this section, Mr. Ávila highlighted the importance of knowing the degree of interconnectedness in the financial system to measure potential risks for financial stability. In this regard, it is important to have data (including FinTech firms) about the transactions of financial intermediaries. Furthermore, the technological advances and the standardizing of data could have an important role in data collection, disseminating, and sharing data. The presenter talked about the legacy systems burdens that jurisdictions could adopt, such as the Legal Entity Identifier code (LEI) and the use of regulatory sandbox. The latter to assess business models and identify potential risks in the financial system stability in a safe environment.

Finally, the Banco de México representative introduced the Fintech Mexican Law, which he explained is required to provide a clear set of rules to bring confidence to the participants with the main goal of preserving financial stability.

Dr. Bruno Tissot, BIS

Presentation ![]()

The Irving Fisher Committee on Central Bank Statistics (IFC) presented the results of the survey conducted in 2019, which was responded by 2/3 of 92 IFC members, and includes a specific additional focus on the Latin American and the Caribbean region (with CEMLA support). The IFC Report Central Banks and Fintech Data Issues was briefly described, also their main findings.

Some of the principal results are concerning the position of FinTech definition on central banks. The presenter explained that less than half (43%) of central banks has a definition of FinTech firms. Additionally, around 70% of the jurisdictions highlighted that FinTech firms have more presence on payment systems and as well as in credit intermediation. Central banks users pointed out the need for FinTech data, especially, on payments systems and financial stability areas. The areas in which jurisdictions pointed out FinTech is creating gaps are payment, financial accounts, list of financial institutions among others. Other reasons FinTech are creating data gaps consist of a lack of granularity of the current statistical framework and the misclassification of FinTechs outside the financial sector (some of them are initially set up as IT companies).

Some of the initiatives that jurisdictions consider to close data gaps are collecting loan-level data, adjust reporting requirements, and collect financial statements, mainly. Regarding concrete initiatives to close FinTech data gaps, on the one hand, 60% of the high-FinTech countries (Australia, Brazil, Canada, France, Germany, Ireland, Israel, India, Japan, Korea, Singapore, Switzerland, the United Kingdom, and the United States) are launching statistical initiatives to close FinTech data gaps. On the other hand, around 30% of the low-FinTech jurisdictions have launched an initiative to address FinTech data gaps. For instance, the collection of data from financial intermediaries and gathering data from financial services users. Additionally, international coordination is important for jurisdictions to close data gaps. Finally, Mr. Tissot presented some useful considerations, such as improving statistical methodologies (standardization and adopt manuals), monitoring, leverage on IT innovation, and the classification of economic activities to consider FinTechs.

Dr. Serafín Martínez-Jaramillo, CEMLA.

Presentation ![]()

CEMLA presented the Financial Information Forum and Fintech Forum and the close work between those forums. The Fintech Forum has currently two working groups: i) Fintech Data Gaps, and b) Central Bank Digital Currencies. In the Fintech Data Gaps group, currently, some participant countries of the FIF are working.

The Policy Report on Fintech Data Gaps was presented, the report aims to provide an overview of the main issues related to data gaps to facilitate monitoring of FinTech and overcome the significant challenges towards incorporating FinTech activities in regular statistics The document explains the implication of data gaps on some of the central bank’s main areas, among others: monetary policy, financial stability, and payment systems. Also, it describes the main findings based on the Irving Fisher Committee (IFC) survey “Central Banks and Fintech data” answered by 16 Latin American and the Caribbean (LAC) countries and their different positions regarding this topic and the current initiatives that each one is launching. The next steps proposed based on a policy discussion, and how LAC countries could overcome data gaps and improve data collection based on their current experience, were also presented.

Meeting conclusions and FIF next steps (only for CEMLA FIF members).

In this session all FIF members discussed the findings and main conclusions of the VI Meeting, as well as the proposal of new ideas for the continuity of the Forum. Session chaired by FIF Executive Committee.

1 Rigobon, Roberto, Quantum Prices (January 2020). NBER Working Paper No. w26646. Available at SSRN: https://ssrn.com/abstract=3518259

2 Cavallo, Alberto, and Roberto Rigobon. 2016. "The Billion Prices Project: Using Online Prices for Measurement and Research." Journal of Economic Perspectives, 30 (2): 151-78.

Wednesday, May 27

Welcome remarks ![]()

Dr. Manuel Ramos Francia, Director General, CEMLA

Session 1. Keynote: “New techniques for gathering and analyzing information for monitoring financial and price stability”

Dr. Roberto Rigobon, MIT.

End of the session.

Thursday, May 28

Speaker introduction and agenda

Dr. Serafín Martínez Jaramillo, CEMLA.

Session 2. Quality and Confidentiality of data / Data science techniques for the collection and analysis of financial information

Dr. Stefan Bender, Deutsche Bundesbank.

End of the session.

Friday, May 29

Speakers introduction and agenda

Dr. Serafín Martínez Jaramillo, CEMLA.

Session 3. New participants of the financial system and information needs (Fintech)

MSc. Ávila, Banco de México

Dr. Bruno Tissot, BIS

Dr. Serafín Martínez Jaramillo, CEMLA.

Meeting conclusions and FIF next steps (only for CEMLA FIF members).

End of the session.

Serafín Martínez-Jaramillo

Advisor, CEMLA

Serafin Martinez-Jaramillo is a senior financial researcher at the Financial Stability General Directorate at Banco de México and currently he is an adviser at the CEMLA. His research interests include: financial stability, systemic risk, financial networks, bankruptcy prediction, genetic programming, multiplex networks and machine learning. Serafin has published book chapters, encyclopedia entries and papers in several journals like IEEE Transactions on Evolutionary Computation, Journal of Financial Stability, Neurocomputing, Journal of Economic Dynamics and Control, Computational Management Science, Journal of Network Theory in Finance and some more. Additionally, he has co-edited two books and two special issues at the Journal of Financial Stability. Serafin holds a PhD in Computational Finance from the University of Essex, UK and he is member of the editorial board of the Journal of Financial Stability, the Journal of Network Theory in Finance and the Latin American Journal of Central Banking.

Roberto Rigobón Ph.D.

Professor of Applied Economics at the MIT Sloan School of Management.

Roberto Rigobon is the Society of Sloan Fellows Professor of Management and a Professor of Applied Economics at the MIT Sloan School of Management.

He is also a research associate of the National Bureau of Economic Research, a member of the Census Bureau’s Scientific Advisory Committee, and a visiting professor at IESA.

Roberto is a Venezuelan economist whose areas of research are international economics, monetary economics, and development economics. Roberto focuses on the causes of balance-of-payments crises, financial crises, and the propagation of them across countries—the phenomenon that has been identified in the literature as contagion. Currently he studies properties of international pricing practices, trying to produce alternative measures of inflation. He is one of the two founding members of the Billion Prices Project, and a co-founder of PriceStats.

Roberto joined the business school in 1997 and has won both the "Teacher of the Year" award and the "Excellence in Teaching" award at MIT three times.

He received his PhD in economics from MIT in 1997, an MBA from IESA (Venezuela) in 1991, and his BS in Electrical Engineer from Universidad Simon Bolivar (Venezuela) in 1984. He is married with three kids.

Stefan Bender Ph.D.

Head of the Research Data and Service Center of the Deutsche Bundesbank.

Stefan Bender is Head of the Research Data and Service Center of the Deutsche Bundesbank. In addition, he is vice-chair of the German Data Forum (www.ratswd.de). Before joining the Deutsche Bundesbank, Bender was head of the Research Data Center (RDC) of the Federal Employment Agency at the Institute for Employment Research (IAB), which he has international established a research data centre including access to IAB data in the US (for example Berkeley, Harvard). Between 1/2017 and 4/2019 he was chair of INEXDA (the Granular Data Network). His research interests are data access, data quality, merging administrative, survey data and/or big data and record linkage. He has published over 100 articles in journals including the American Economic Review or the Quarterly Journal of Economics. More recently, he co-edited together with Julia Lane, Victoria Stodden and Helen Nissenbaum a volume on "Privacy, Big Data, and the Public Good: Frameworks for Engagement", which was published in 2014 by Cambridge University Press and –for example –discussed in Science.

Bruno Tissot

Head of Statistics & Research Support. Head of Secretariat, Irving Fisher Committee on Central Bank Statistics (IFC). Monetary and Economic Department.

Bruno Tissot has been working at the BIS since 2001, as Senior Economist and Secretary to the Markets Committee of Central Banks in the Monetary and Economic Department and then as the Adviser to the General Manager and Secretary to the BIS Executive Committee. Between 1994 and 2001 he worked for the French Ministry of Finance. He is currently Head of BIS Statistics and Research Support and is a graduate from École Polytechnique (Paris) and of the French Statistical Office INSEE.

Fields of interest:

-

Statistics, econometrics and innovation

-

Business cycles and forecasting

-

Fiscal, monetary and financial stability issues