Disponible en

Español

![]()

II Regional Conference on Payments and Financial Market Infrastructures

Call for Papers

II Regional Conference on Payments and Financial Market Infrastructures

Bogotá DC, Colombia, September 21-22, 2023

Payment systems and financial market infrastructures (FMIs) are rapidly evolving and presenting new opportunities and challenges for emerging economies. Innovation and new technologies call for the strengthening and consolidation of FMIs to ensure a safer and more efficient backbone for the financial system. While recent developments may boost efficiency, competition, and financial inclusion, they also pose pressing public policy questions on how to unlock such opportunities and contain the risks that may arise going forward. Issues that have recently called the attention of central banks include but are not limited to: public versus private provision of FMIs; the growth of fintech and the crypto ecosystem and their regulation; central bank digital currencies (CBDCs); cross-border payments; and the oversight and risk management of financial innovations.

The Center for Latin American Monetary Studies (CEMLA) and Banco de la República (BR), the Central Bank of Colombia, invite researchers from academia, central banks, and other public and private institutions from Latin America, the Caribbean and abroad to participate in our joint Conference and to contribute to ongoing discussions related to these developments.

The Conference will include keynote and academic sessions, bringing the latest developments in the field.

Topics

We encourage the submission of work related, but not exclusive, to the following topics:

- Developments in retail payments and policy implications: fintech, fast or instant payments, central bank digital currencies (CBDCs), and public versus private provision of retail payment services.

- Developments in wholesale FMIs: custody, trading, liquidity, settlement, and risk management.

- Developments in cross-border payments: fintech, integration of fast or instant payments, multi central bank digital currencies (m-CBDCs), and other private emerging business models.

- Payments regulation: cybersecurity, interchange fees, accessibility and interoperability, regulatory sandboxes, new payment service providers.

- Cash and cashless payments: trends and factors driving the use of alternative means of payment and the impact of COVID19 on payments.

- FMIs, financial stability, and monetary policy.

- New technologies for FMIs: use of distributed ledger technology (DLT), artificial intelligence (AI), and machine learning (ML).

- Novel applications of FMI datasets: utilization of new datasets, big data or data science in the areas of financial stability, monetary policy, financial supervision, oversight, and regulation.

Submission and relevant dates

Preference will be given to completed papers, but summaries and extended abstracts will also be considered. Papers should be submitted to: dimf@cemla.org

- April 13, 2023. Submission deadline

- July 18, 2023. Decision results

- September 1, 2023. Submission of final version of accepted papers

In-person participation is encouraged for speakers and discussants, although hybrid sessions could be arranged for those with travel restrictions. Travel and accommodation costs of presenting authors should be covered by the authors’ institutions.

Scientific Committee

- Biliana Alexandrova, Banco de México

- Carlos Arango-Arango, Banco de la República

- Carlos León, FNA

- Cyril Monnet, University of Berna

- Gerardo Hernandez-del-Valle, Center for Latin American Monetary Studies

- James Chapman, Bank of Canada

- Jon Frost, BIS Economics for the Americas

- Jorge Cruz Lopez, University of Western Ontario

- Marianne Verdier, Universitè Paris II Panthèon-Assas

- Matti Hellqvist, Bank of Finland

- Morten Bech, BIS Innovation Hub

- Rod Garratt, Bank for International Settlements

- Ronald Heijmans, De Nederlandsche Bank

- Santiago Carbó-Valverde, Universidad de Valencia

- Serafín Martinez-Jaramillo, Banco de México

Publication

Authors of papers selected for the conference will be invited to submit their work to the Latin American Journal of Central Banking (https://www.cemla.org/lajcb/index.html).

II Regional Conference on Payments and Financial Market Infrastructures

Upcoming publication

II Regional Conference on Payments and Financial Market Infrastructures

To be announced

II Regional Conference on Payments and Financial Market Infrastructures

Call for Papers

September 21-22, 2023 – Bogotá DC, Colombia

Venue Information

CEMLA is located in Durango 54, Col. Roma Cuauhtémoc, C.P. 06700 Ciudad de México, México; near downtown Mexico City.

Mexico City is located near the center of the country, at an average altitude of 2,300 meters above sea level, bordering the State of Mexico and the state of Morelos. The capital is connected by land to multiple destinations.

Time Zone

Mexico has a time difference with Greenwich Mean Time of -6 hours throughout its territory. The country has a daylight saving time that begins in April 3, 2022 and ends in October 30, 2022.

Weather

In Mexico City, the wet season is warm and overcast and the dry season is comfortable and partly cloudy. Throughout the year, the temperature usually ranges from 6°C to 26°C and is rarely below 3°C or above 30°C.

The warm season lasts for 2.5 months, from March 22 to June 8, with an average daily temperature above 20°C. The hottest month of the year in Mexico City is May, with an average high of 27°C and low of 13°C.

The cool season lasts for 2.5 months, from November 19 to February 3, with an average daily high temperature below 22°C. The coldest month of the year in Mexico City is January, with an average low of 6°C and high of 22°C.

Visa Information

All participants are responsible for all Passport and visa formalities, and if needed, to comply with health regulations.

Citizens of certain countries require a visa to enter Mexico. In the following link you will find a list of citizenships which require visas: Countries that require visas.

Exceptions apply if you have a visa or if you are a permanent resident of the United States, Canada or Europe. If you are a citizen of a country requiring a visa, please contact the closest Mexican consulate at: Mexican consulates. For more information, please click here.

If you require an invitation letter in order to obtain the visa, please email Olivia Fuentes (ofuentes@cemla.org) specifying your current affiliation and title of the paper that you will be presenting.

Currency and Exchange Rate

Official currency: Mexican peso (MXN).

Average exchange rate is around: $20.00 USD/MXN. For the updated exchange rate click here.

You will be able to make currency exchanges at exchange houses and in some bank offices. It is recommended to exchange money at the airport since exchange houses and banks near CEMLA and the suggested hotels are closed on weekends, and close early during the week (around 16:00 hrs). Usually, ATMs are available 24 hours. You may draw cash using international debit and credit cards with worldwide brands, like Visa, Mastercard, Visa Electron and Dinners. For more information, please visit (Banco de México) here.

VAT and others

- · VAT: 16%.

- · Hotel service: additional charge of 3% on top of lodging (ISH or lodging tax).

- · Tips at restaurants: from 10% to 15% depends on the service you have received.

Electricity Service

Energy: 127 volts AC at 60 cycles (127V AC, 60 Hz). Two flat-pin plugs and some with grounding.

Transportation

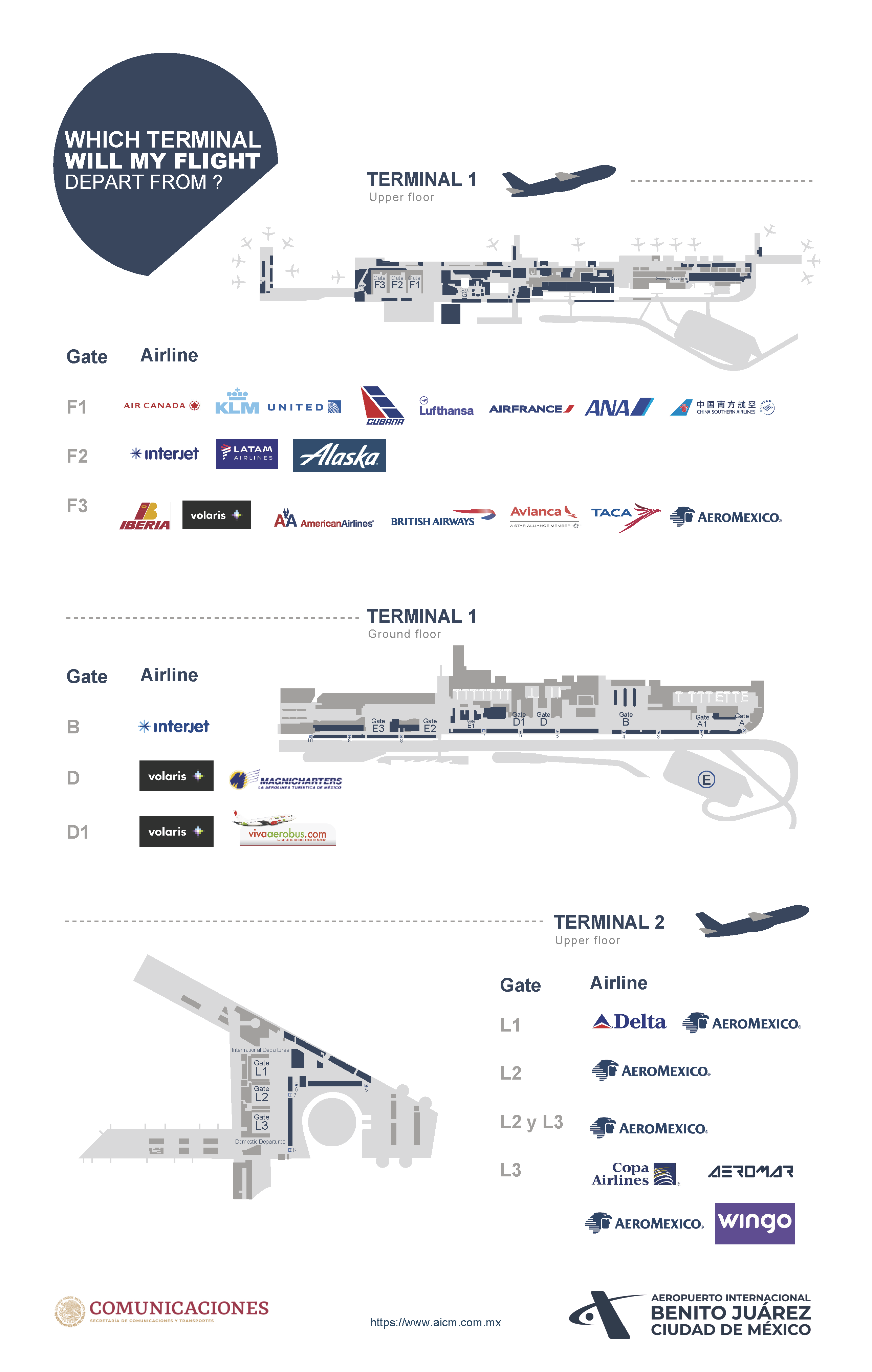

The Benito Juárez International Airport in Mexico City is located 13 kilometers from the Downtown. It has two terminals which are identified by Terminal 1 and Terminal 2 and both are connected by aerotrain and free bus transportation. For more information, you may find the airport website here.

When arriving to Mexico City, transportation from the airport to hotels can be done by transportation apps (such as Uber, Cabify, Didi and Lyft, among others), or taxi. For taxi transportation it is important to select a taxi company inside the airport (there are different options to select from once you exit customs and immigration), pay the cashier inside the airport and ask for the cab in the corresponding exit. The Mexico City International Airport (AICM) offers spaces or boarding areas for the use of authorized cabs accredited by the Ministry of Communications and Transportation (SCT) and regulated by the Airport, for more information on authorized cabs click here.

For transportation in Mexico City, we recommend participants to use transportation apps or taxi service taken from “SITIO” stands. We recommend that participants avoid taking taxis from the street. SITIO stands can be found in several locations and phone numbers to call for taxis can be obtained in the hotels.

CEMLA, will not provide transportation services.

Accommodation

The following table shows CEMLA’s recommended hotels, the rates available to events participants and hotel contact information. Booking hotel is the visitors’ responsibility. Consider that hotels usually request a credit card to guarantee the reservation. For any of the booking options, remember to add 3% ISH tax and 16% VAT.

To receive the corporate rate in the recommended hotels you must specify the name of CEMLA. Any change of rates is the responsibility of each hotel. Even though some bookings can be made online we recommend contacting the hotel directly to make sure the group rate is given.

Recommended Hotels

Hotel

Rates

Reservation information

Stanza

Av. Álvaro Obregón 13, Roma Nte., Cuauhtémoc, 06700 Ciudad de México, CDMX

(3-minute car trip, 6-minute walk, 500m to CEMLA)

Ordinary rate per night:

$112.11 USD

CEMLA corporate rate:

$68.95 USD

Includes:

wi-fi, coffee maker

Phone: + 52 55 5208 0052

Royal Reforma

C. Amberes 78, Juárez, Cuauhtémoc, 06600 Ciudad de México, CDMX

(10-minute car trip, 13-minute walk, 1 km to CEMLA)

Ordinary rate per night:

$144.00 USD

CEMLA corporate rate:

$69.00 USD

Includes:

wi-fi, breakfast buffet

Phone: +52 55 9149 3000

Four Points by Sheraton

Av. Álvaro Obregón 38, C. U. Benito Juárez, Cuauhtémoc, 06700 Ciudad de México, CDMX

(5-minute car trip, 6-minute walk, 500 m to CEMLA)

Ordinary rate per night:

$ 2,434.00 MXN

CEMLA corporate rate:

$ 2,076.91 MXN

Includes:

wi-fi, parking

Phone: +52 55 1085 9500

City Express Plus Reforma El Angel

Av. Paseo de la Reforma 334, Juárez, Cuauhtémoc, 06600 Ciudad de México, CDMX

(10-minute car trip, 20-minute, 1.6 km walk to CEMLA)

Ordinary rate per night:

$ 2,700.00 MXN

Includes:

wi-fi, breakfast

Phone: +52 55 5228 7800

Sheraton Mexico City María Isabel

Av. Paseo de la Reforma 325, Cuauhtémoc, 06500 Ciudad de México, CDMX

(13-minute car trip, 21-minute walk, 1.6 km to CEMLA)

Ordinary rate per night:

Please consult directly with the hotel.

CEMLA corporate rate:

$183.69 USD

Includes:

wi-fi, breakfast buffet, gym

Phone: +52 55 52425672

Marriot Reforma

Av. Paseo de la Reforma 276, Juárez, Cuauhtémoc, 06600 Ciudad de México, CDMX

(15-minute car trip, 17-minute walk, 1.3 km to CEMLA)

Ordinary rate per night:

$ 7,850.00 MXN

CEMLA corporate rate:

$ 3,776.20 MXN

Includes:

wi-fi, wi-fi in business center, breakfast buffet, gym

Phone: +52 55 1102 7030

Brick Hotel

Orizaba 95, Roma Nte., Cuauhtémoc, 06700 Ciudad de México, CDMX

(6-minute car trip, 7-minute walk, 500 m to CEMLA)

Ordinary rate per night:

$ 7,125.00 MXN

Phone: +52 55 9155 7610

Map

Visit Mexico

Mexico City is a unique visitor destination offering a wide range of attractions combining historic and modern-day life in a vibrant and friendly atmosphere. Take a day to visit the pre-Hispanic ruins of Teotihuacan, or visit the Centro Histórico and marvel at its rich architecture form the Catedral and Plaza del Zócalo to Palacio de Bellas Artes, visit world-class museums, or spend the day at some of the modern-day bustling neighborhoods and enjoy a fine dining experience at some of the world’s top-rated restaurants. For more information visit: http://cdmxtravel.com/en/.

Dinning

Mexico City offers a wide variety of restaurants most of them located in the tourist areas of Polanco, Roma and Condesa near the Conference Venue.

Sightseeing/Day trips

If you are planning to stay an extra day or two in Mexico City, we recommend taking a day to visit the Centro Histórico, Coyoacán, Reforma Avenue, Colonia Roma, Xochimilco, and Chapultepec.

A day trip to Teotihuacan to see the pyramids can be arranged with the hotel concierge.

Mexico City offers some world class museums including the Anthropology Museum, the Museo Soumaya, and the Interactive Museum of Economics.

COVID-19 Protocol

CEMLA Health Protocol based on the suggestions of the Pan-American Health Organization

- Body-temperature checks and provision of hand-sanitizing gel and face-masks at the entrance of our facilities.

- Limited capacity in rooms to comply with a minimum distancing of 1.5m between individuals.

- Rodrigo Gómez Auditorium has been equipped with an air-ventilation system with UV-C light air purifiers and air-exhaust systems.

- Javier Marquez Room, Multimedia Room, restrooms and boardrooms, among other rooms, have been equipped with UV-C light conditioning.

- CO2 and humidity monitors in the main spaces of the building.

- Open-door room policy.

- Cleaning and maintenance plans after regular occupation hours.

- Regular updates based on the tracking of recommendations of the health authorities in Mexico and International Organizations.