August 24, 2017

FinTech: key issues and challenges for central banks

In light of the impact that new technologies and innovation have had in the financial world, reflected in the emergence of new agents, business models, products and solutions that lead to a new landscape for financial markets and infrastructures, key central banking functions has been affected. These brief highlights key issues and challenges that merit the attention of the Latin American and Caribbean central banking community.1

The FinTech key issues

Customers' experience comes first. Digital transformation and technological innovations in the financial sector are favoring the emergence and increased availability of methods (products and solutions) with greater speed (immediacy) and integration (less friction) to use different financial services. Strategies and business models are targeting to a scenario in which the customer is first, financial services are even becoming just a part of the experience offered, and product design is increasingly benefiting from data related to customers habits and preferences.

Cooperation, then competition. The entrance of FinTech companies into the current ecosystem is occurring in a more collaborative than competitive way. These new actors need the traditional ones for example, banks— either to access infrastructures and payment systems or to rely on the knowledge and trust that said actors have gained with their clients. Traditional actors, on the other hand, need to cooperate with the new ones to adapt to the technological changes. This combination of forces could make the financial sector a more efficient and competitive one if it is rightfully balanced.

The systemic nature of FinTech. Some new players —such as telecommunications, e-commerce and other global scale companies— already have high market shares in the information and communication technologies sector. These big companies also have —and know how to exploit— large and varied datasets to adapt their supply of goods and services to the customers' needs. This advantage, if not properly directed, can become a challenge in terms of competition and risk management for the financial sector, and the economy as a whole.

Central bank challenges

FinTech is transforming the financial industry and, consequently, is having a significant impact on the way central banks operate towards the financial and monetary stability. As a result of this transformation, central banks are required to adapt with a clear strategy capable of responding to a changing world (new agents, different jurisdictions, new business models, etc.). The opportunities offered by technological change also entail new risks for the economy and central banks must ensure that the public understands these risks.

While some central banks will have to revise their legal mandate to achieve this strategy, in general there seem to be enough room to address technological-driven challenges considering the mandates of price stability, efficiency of the financial system, and good functioning of payment systems. Central banks with mandates to foster financial inclusion or promote economic development have the scope to be more proactive.

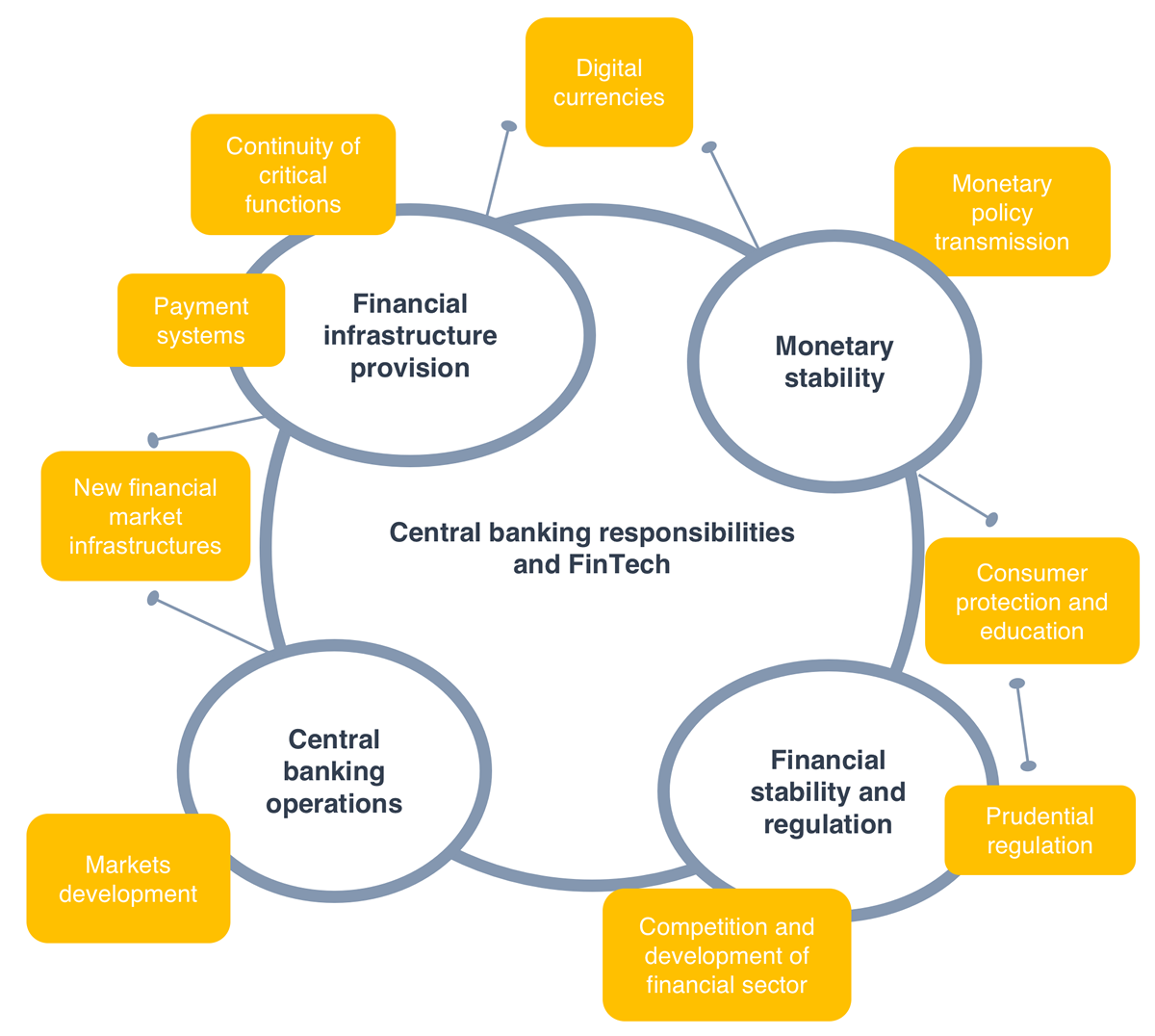

The following chart illustrates some of the most relevant responsibilities of central banks that may be more exposed to FinTech driven-changes.

With the rapid FinTech disruption, key functions of the central bank are already under change, the following highlights some related challenges that could merit greater and prompt attention from the authorities:

- Competition and development in the financial sector. Central banks face the challenge to implement a strategy towards a level playing field and competitive scenario for traditional and new actors in the financial ecosystem, such that are in line with desirable and minimum-acceptable levels of safety and efficiency for financial stability purposes. To this end, some traditional approaches related to how competition is measured or the central bank's catalytic role, should be reviewed to address issues such as the financial access, in a context of democratization of telecommunications.

- Prudential regulation. The approach that financial regulation should have for FinTech poses major challenges related to the treatment that is most appropriate for each country. There is the trade-off between the use of rules (guaranteeing predictability, but of slower implementation) or principles (allowing flexibility and adaptation, but may create discretion); or between maintaining the same standards for the same risks (i.e. regulating services and not actors) or promoting proportionality in standards (to encourage innovation). Whatsoever the adopted approach is, inter-institutional aspects such as prudential supervision, market conduct and competition, financial education and consumer protection, telecommunications, among others, must be considered.

- Consumer protection and education. There are important implications and challenges associated with financial inclusion and access that are explained by the need to have a framework of consumer protection and education in view of the greater presence of FinTech and, in general, of the digital transformation in financial services and the economy. These challenges include, among others, the development of skills for effective use of financial services in their new forms, and the implementation of integral policies to avoid financial customers get overindebted or subject to inadequate behavior.

- Issuance of digital currency. The issue is challenging from any economic point of view, but very recently central bank has changed their view and are acute to understand and work towards the use of digital currencies, especially if central bank takes the lead in its issuance. Recent projects testing new technologies (particularly those related to Distributed Ledger Technologies) in the development of digital currencies, and even in other areas of payments and market infrastructures, such as the provision and management of platforms underpinning existing or new infrastructures for financial assets trading, clearing and registry. Such experiments have proved that time is needed to demonstrate the usefulness and advantages of using new technologies; in particular, and this is evident, because existing infrastructures have proven to be safe and sound, and have remained in constant modernization taking advantage of technological improvements in the industry. Going forward, the challenge of finding the right use of technology to issue a digital currency to be easily adopted by the public will remain for central banks.

Besides the abovementioned challenges, the community of Latin American and Caribbean central banks may deal with additional challenges arising from economic informality, lack of physical infrastructure and telecommunications (internet, mobile telephony) and growing financial education, to allow FinTech and —in general— the digital transformation to take place and spill the benefits over the economy throughout the unbanked and underbanked economic agents.

In consequence and looking ahead, it is desirable that central banks work towards a strategy to deal with FinTech to take advantage of the imminent democratization driven by digital technological change as a mechanism to close said gaps. The resulting strategy will be one that —while allowing central banks to fulfill their mandates and responsibilities of financial and monetary stability— leads to a proportionate and balanced regulatory environment, mindful of existing economic and social reality, consumer needs, and incentives and interests for various financial industry stakeholders and other relevant economic agents.

Raúl Morales

Financial Markets and Infrastructures Manager